2026 Hedge Fund Industry Outlook: Generation Alpha

The Goldman Sachs Prime Insights & Analytics team surveyed over 810 hedge fund allocators and managers to understand their portfolio activity during 2025 and plans for 2026.

Performance

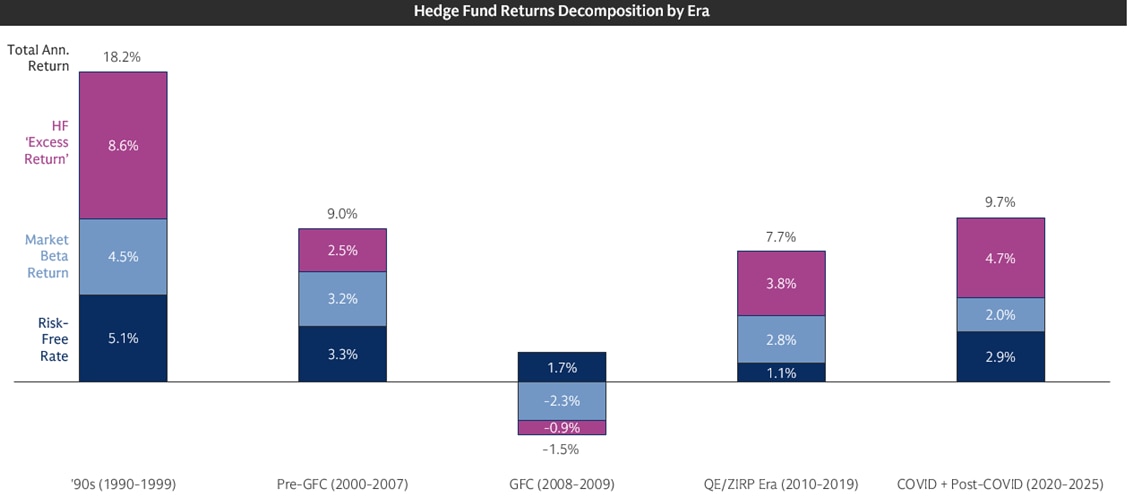

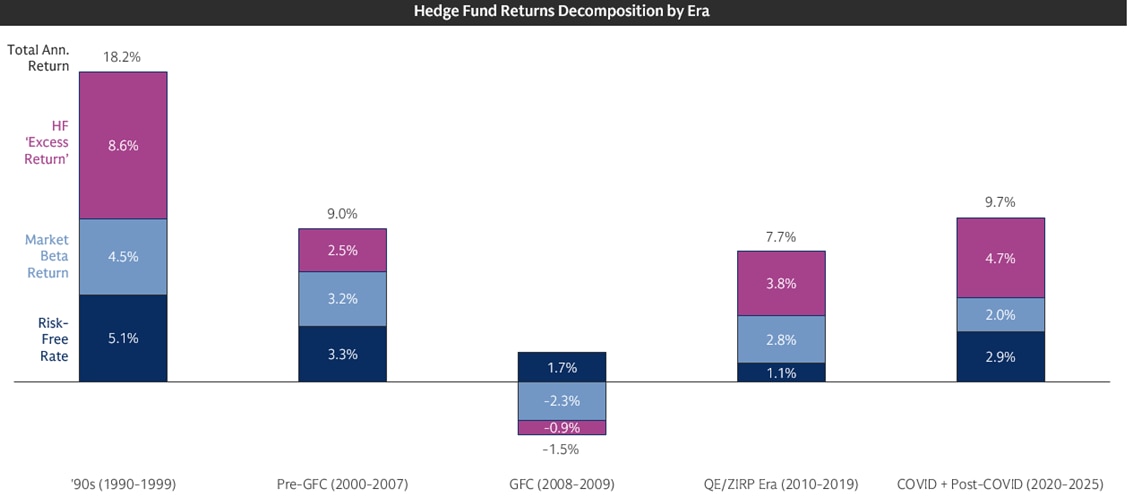

Low rates during the QE era led to more muted hedge fund alpha generation. Since the outset of the US rate-hiking cycle, hedge funds have begun to significantly outperform risk assets.

2025 was the second consecutive year of double-digit performance for hedge funds, delivering an average return of +11.8% - a significantly improved performance backdrop since COVID. More recently, fundamental strategies - especially equity L/S - have seen the strongest returns, supported by rising markets and very strong alpha generation. On a 5-year lookback, however, quant strategies have really excelled.

Due to a bout of extreme factor volatility March 7 and March 10 will go down as one of the worst two-day stretches of hedge fund performance in years (multistrat-mageddon). The momentum factor experienced a 4+ standard deviation drawdown which led to forced derisking across various types of HF strategies. Fortunately this episode led to cleaner positioning as traders braced to enter the second quarter...

Source: Prime insights and analytics, as of 23 January 2026.

Positive Allocator Sentiment

Positive allocator sentiment remains at all-time highs with 91% of allocators saying portfolios had matched or beaten expectations for the second year in a row. Moreover, the share of allocators whose portfolios bettered expectations rose to 49%, the highest level since 2020.

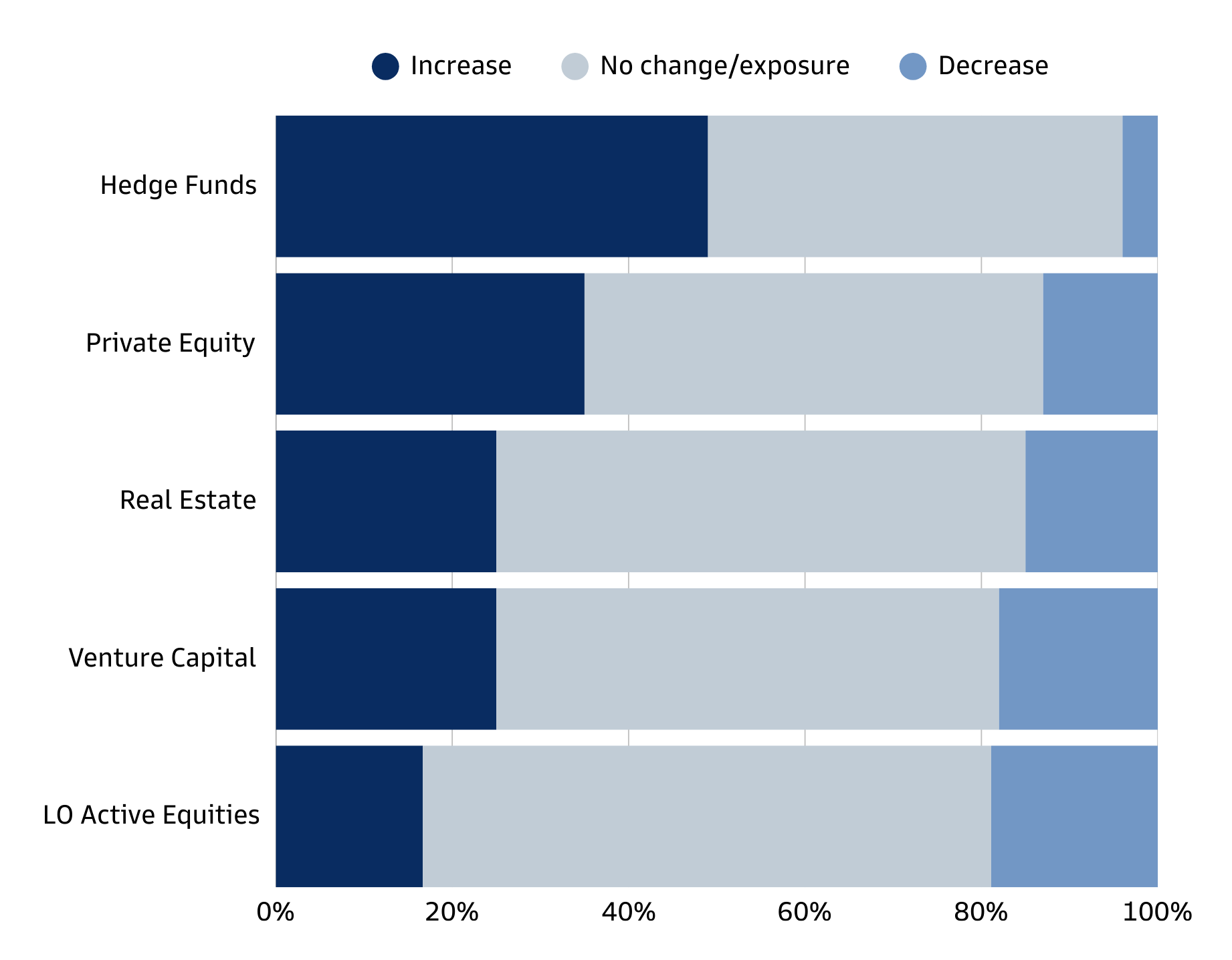

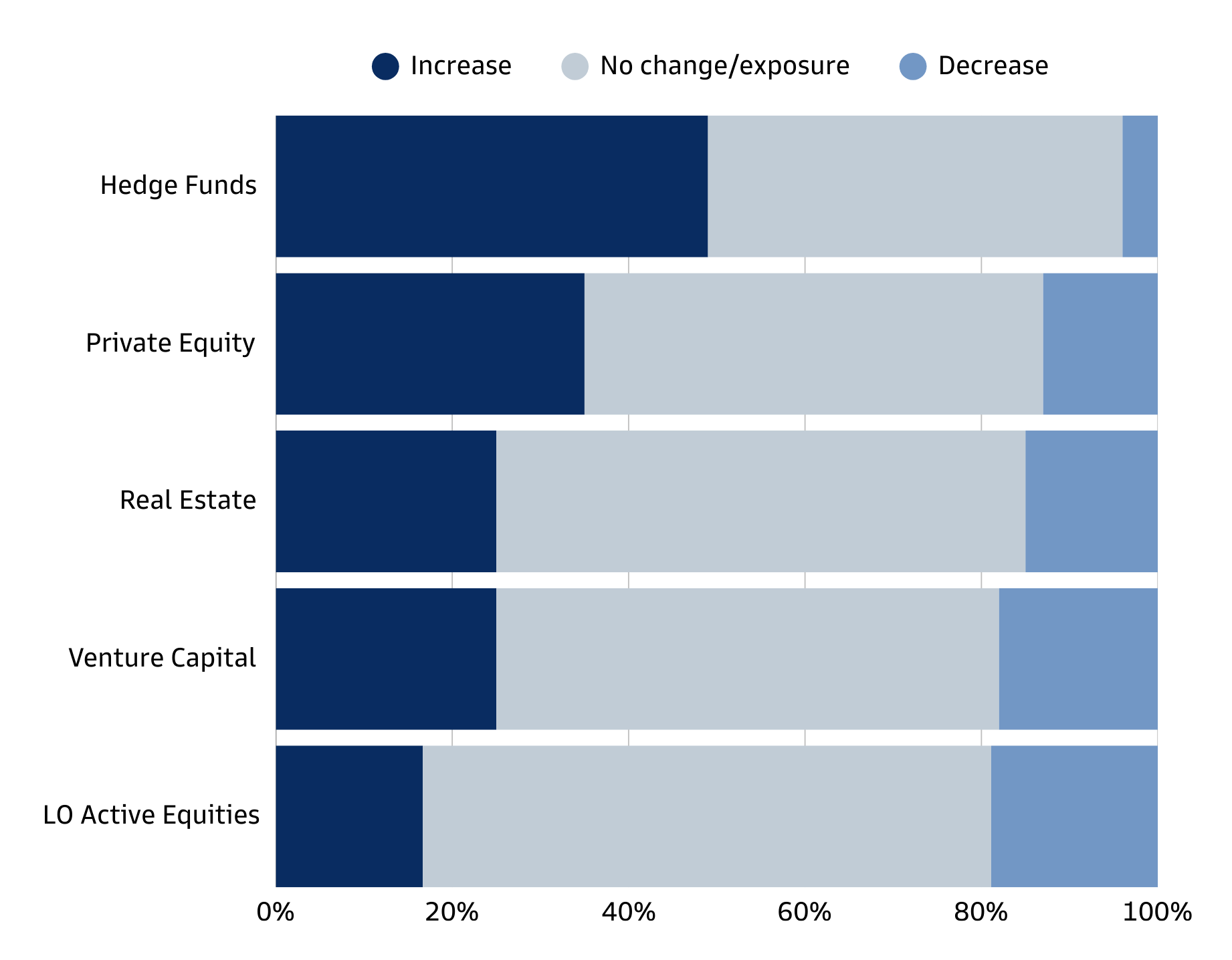

Once again, hedge funds are the most sought-after asset class going into 2026. Moreover, they have grown their lead to an all-time high on our records: almost half of allocators plan to increase their allocation to hedge funds in 2026, compared to just 4% who plan to trim their allocation.

At the same time, interest in most traditional and alternative asset classes has declined.

Source: Prime insights and analytics, as of 23 January 2026.

US Trends & Themes in Hedge Fund Positioning from the Prime Book

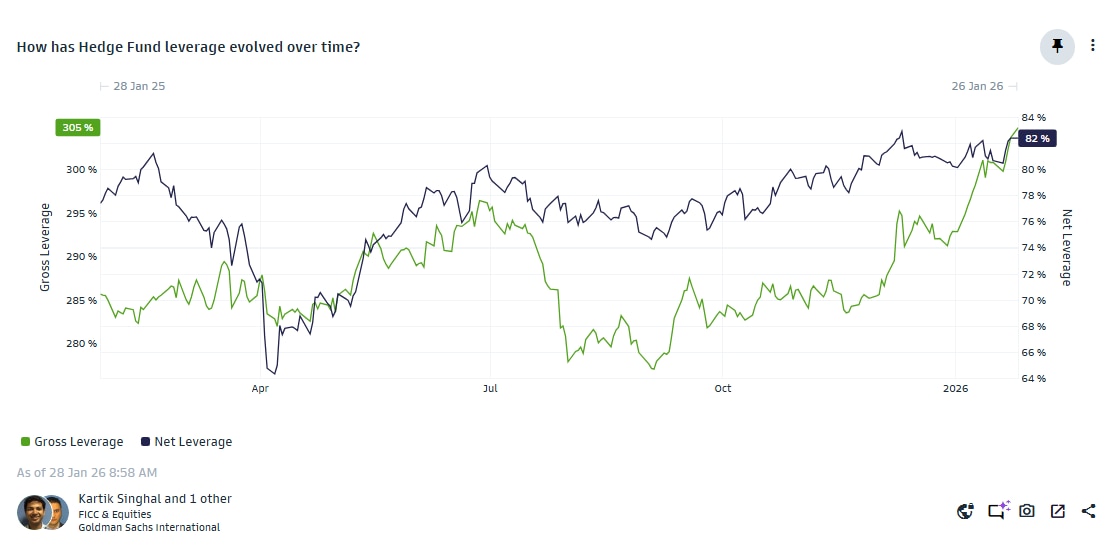

Gross leverage for the full Prime Brokerage book rose for a third straight year to the highest level on record by end-2025, while Net leverage is now near 3-year highs. Gross market values rose in all major regions, but non-US markets (especially Emerging Markets) led the pace of increase last year. Gross and Net allocation in Emerging Markets ex-China rose sharply to record highs in 2025.

Source: Marquee MarketView, as of 26 January 2026.

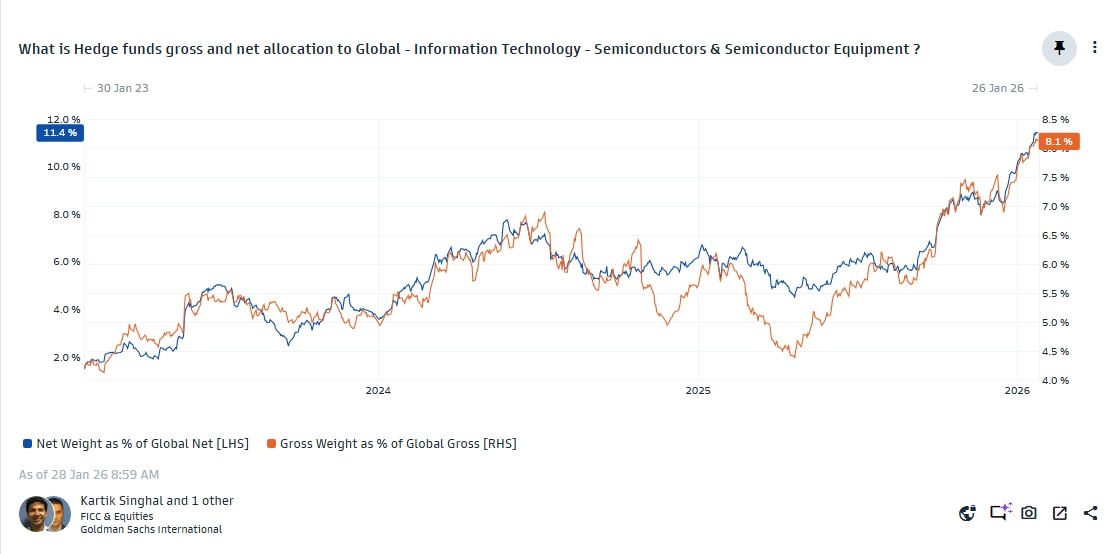

A few themes worth highlighting:

- Magnificent 7 names now make up ~19% of total US net exposure (vs ~11% in early April and a peak of 21% in mid-2024). Hedge funds have continued to rotate into Semiconductors & Semiconductor Equipment for which net exposure is at 5-year highs, and out of Software, for which net exposure has fallen to fresh 5-year lows in 2025.

- Hedge funds have been rotating into Cyclical stocks to start the year and aggressively bought Health Care stocks in 2H25, driven almost entirely by long buys and primarily Biotech stocks.

- Gross allocation to Discretionary has hit new 5-year lows, and Energy was net sold in 8/12 months in 2025.

Source: Marquee MarketView, as of 26 January 2026.

Read the full report on Marquee

The names "Goldman Sachs," and "Marquee" are the trademarks or registered trademarks of Goldman Sachs.

© 2026 Goldman Sachs & Co. LLC. All rights reserved. Descriptions of the products and services available through the Marquee platform provided herein are for educational purposes only and do not reflect all information that may be relevant in determining whether use of any such product or service is suitable for your circumstances. Goldman Sachs is not recommending that you take any action based on any information presented herein, which may be updated or modified form time-to-time by Goldman Sachs in its sole discretion without prior notice or subsequent notification. Prior to utilizing product or service available through the Marquee platform, you should read carefully any related disclosure provided by Goldman Sachs, including any information to which you may be required to agree and acknowledge or any user agreements that you may be required to execute, and make an independent determination regarding the suitability of your use of the relevant product or service.

The reference to or appearance of another company’s name, trademark, or logo in these materials / on this site does not constitute or imply, and is not intended to constitute or imply, any type of affiliation, endorsement, sponsorship, approval, or the like by or between such company and Goldman Sachs or any of their respective products, services, or affiliates. Any such reference or appearance is made for informational purposes. All such names, marks, and logos are the intellectual property of their respective owners.