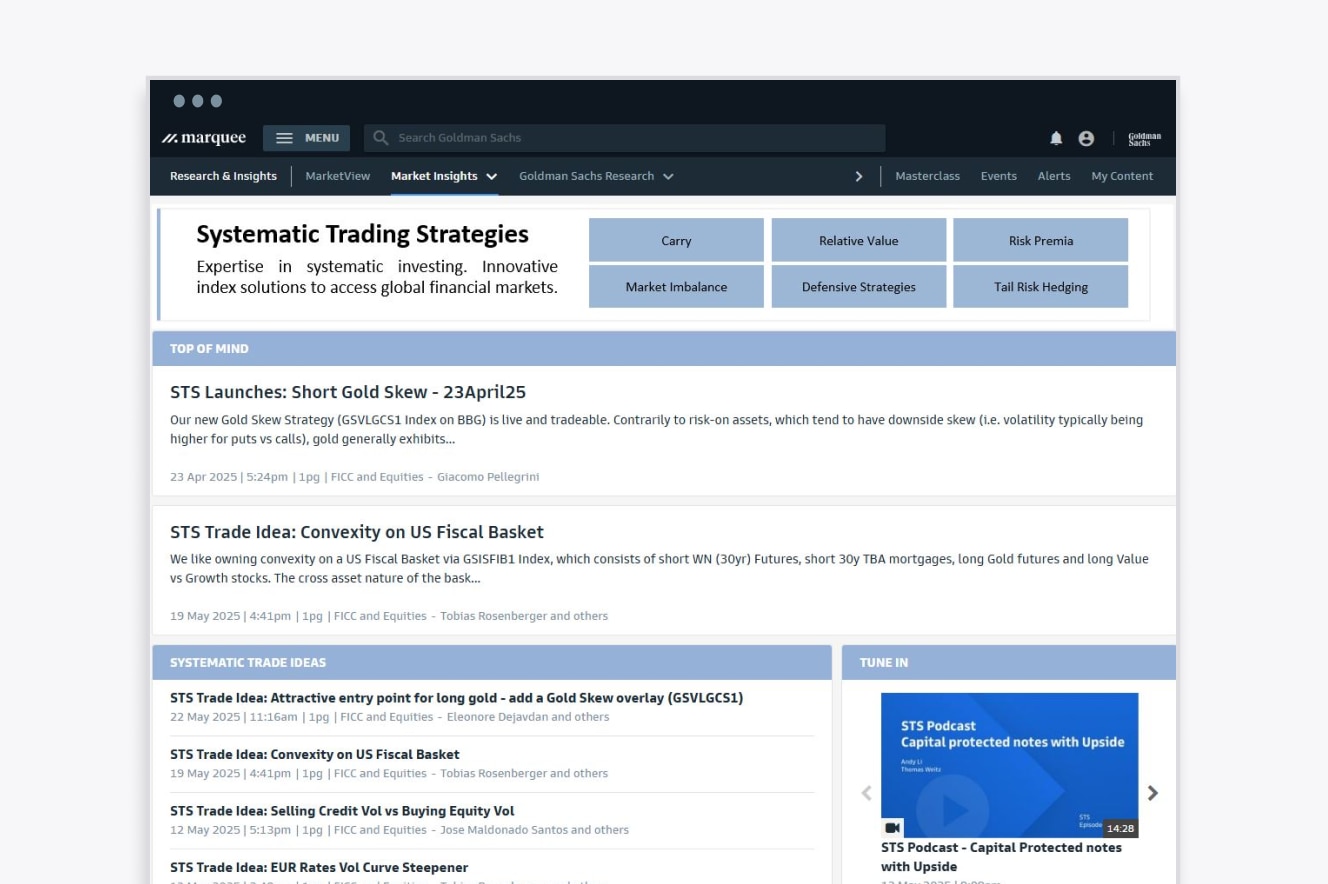

Our systematic investment strategies are an efficient way of investing via rules-based investment solutions encapsulated in the format of an index - allowing operationally easy access to complex strategies across asset classes.

In addition to a broad range of ready-to-trade strategies with live track records, we also offer investors the ability to create custom products to meet their individual requirements.

We also enable our clients to build their own actively managed strategies, leveraging the Goldman Sachs i-Select™ platform via Marquee.

Our strategies can be traded in unfunded and leveraged formats, with daily liquidity.

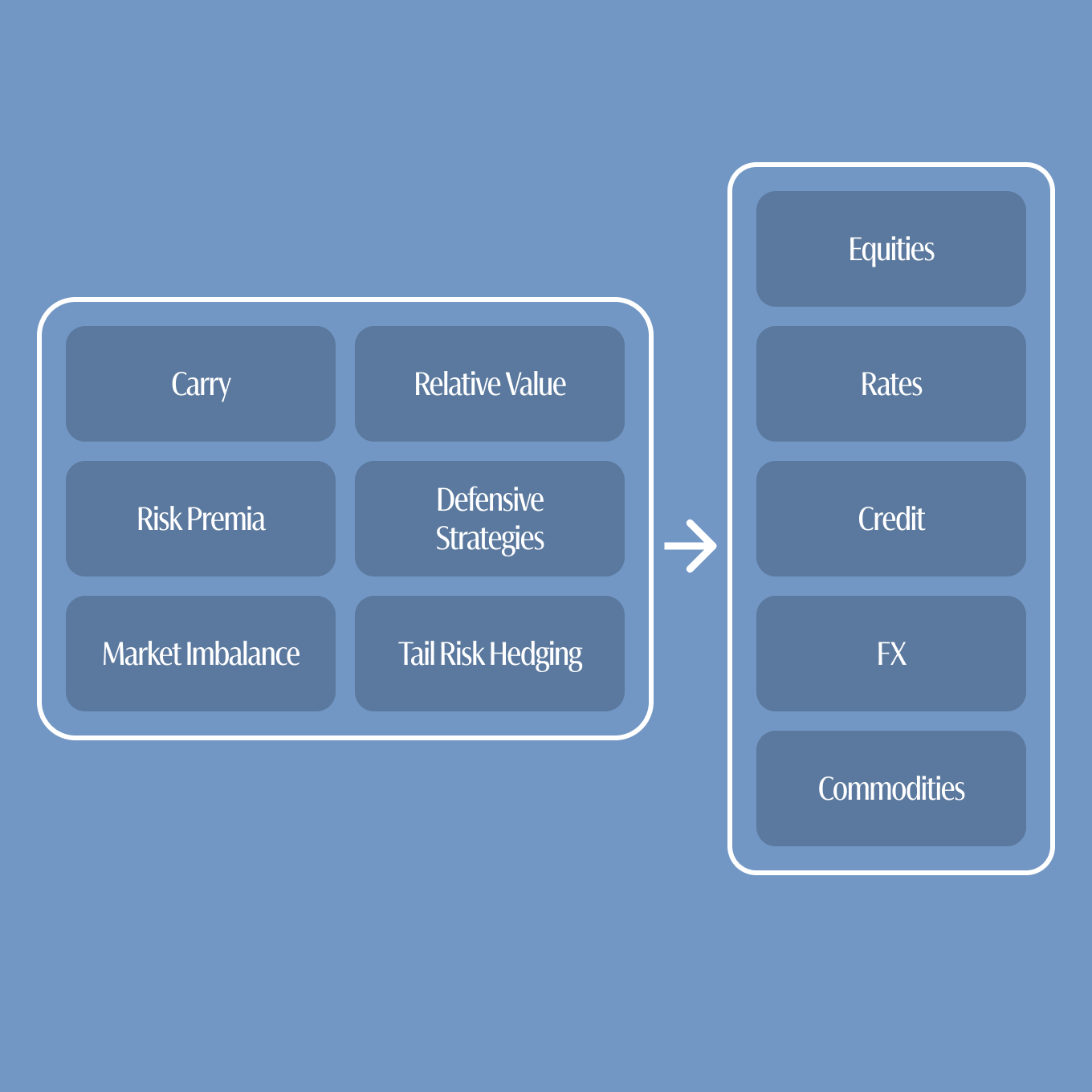

Leveraging exceptional infrastructure, we design systematic indices and strategies on global markets across Equities, Interest Rates, Credit, FX and Commodities, ranging from pure market access to carry, relative value, hedging and defensive oriented strategies, traded standalone or in baskets – including baskets with dynamic weights management.

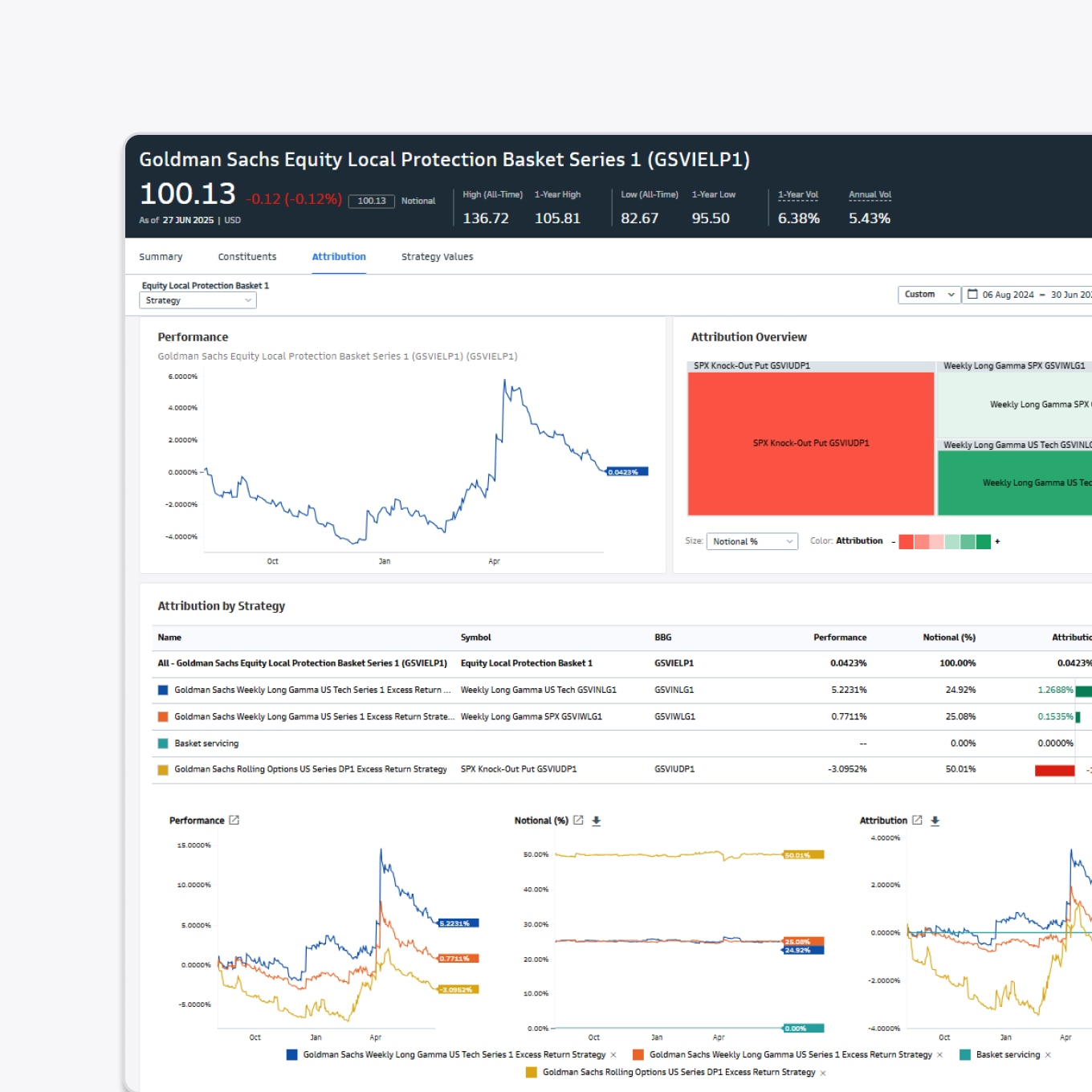

Our platform allows clients to easily visualize and deconstruct index performance across time periods, strategies, regions, styles, and asset classes, and access live performance analysis and attribution, as well as line-by-line granularity and risk of all holdings within the investment.

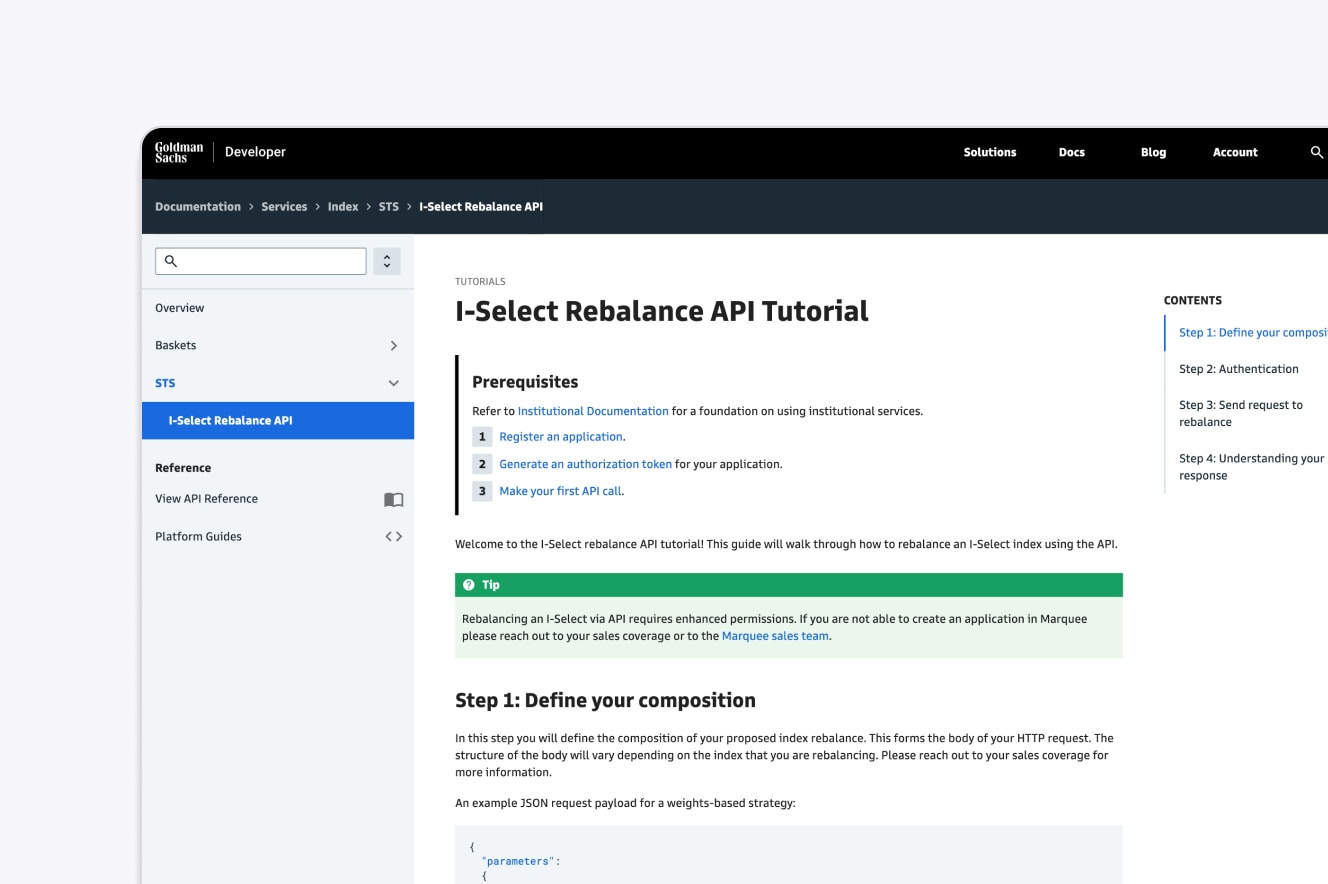

Our clients can retrieve daily index level updates and query historical compositions automatically via API and access live performance and attribution analysis at the basket and constituent level.

Test OTC trade ideas with Marquee Structuring, Marquee's intuitive interface for price discovery and quote sharing, or with GS Quant, Goldman Sachs' Python toolkit for quantitative finance.

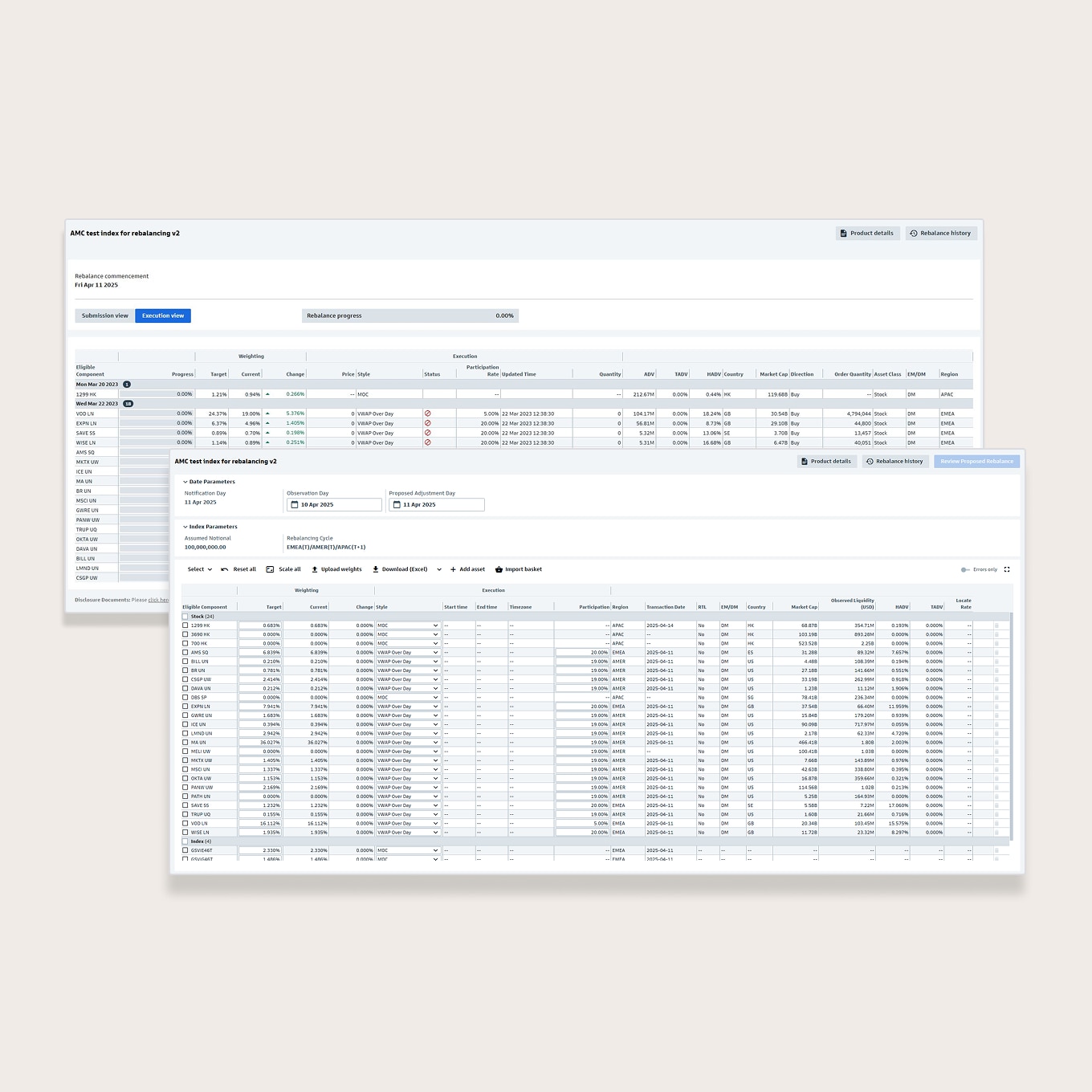

Our Goldman Sachs i-Select™ platform via Marquee allows clients to take control of their allocation and trading decisions, while externalizing operations and execution to Goldman Sachs. By leveraging Goldman Sachs' extensive footprint across products and markets, clients can focus on their core business, investment management.

Clients can adjust their exposures while preserving existing workflows with either the Marquee re-balancing portal, API, or FIX connectivity to the client’s preferred EMS. Bespoke reporting allows clients to seamlessly track their daily exposures and executions, in a format that meets their needs.

Dozens of distributors and managers across the quant or fundamental equity community as well as macro funds and institutional investors already use GS i-Select to trade their exposures and simplify their operations to a single derivative booking.

Browse our extensive catalog of available data and filter by asset class, data type, source, and other filters.

Follow these simple steps to get started and gain programmatic access to data via API.

The names "Goldman Sachs," and "Marquee" are the trademarks or registered trademarks of Goldman Sachs.

© 2026 Goldman Sachs & Co. LLC. All rights reserved. Descriptions of the products and services available through the Marquee platform provided herein are for educational purposes only and do not reflect all information that may be relevant in determining whether use of any such product or service is suitable for your circumstances. Goldman Sachs is not recommending that you take any action based on any information presented herein, which may be updated or modified form time-to-time by Goldman Sachs in its sole discretion without prior notice or subsequent notification. Prior to utilizing product or service available through the Marquee platform, you should read carefully any related disclosure provided by Goldman Sachs, including any information to which you may be required to agree and acknowledge or any user agreements that you may be required to execute, and make an independent determination regarding the suitability of your use of the relevant product or service.

The reference to or appearance of another company’s name, trademark, or logo in these materials / on this site does not constitute or imply, and is not intended to constitute or imply, any type of affiliation, endorsement, sponsorship, approval, or the like by or between such company and Goldman Sachs or any of their respective products, services, or affiliates. Any such reference or appearance is made for informational purposes. All such names, marks, and logos are the intellectual property of their respective owners.