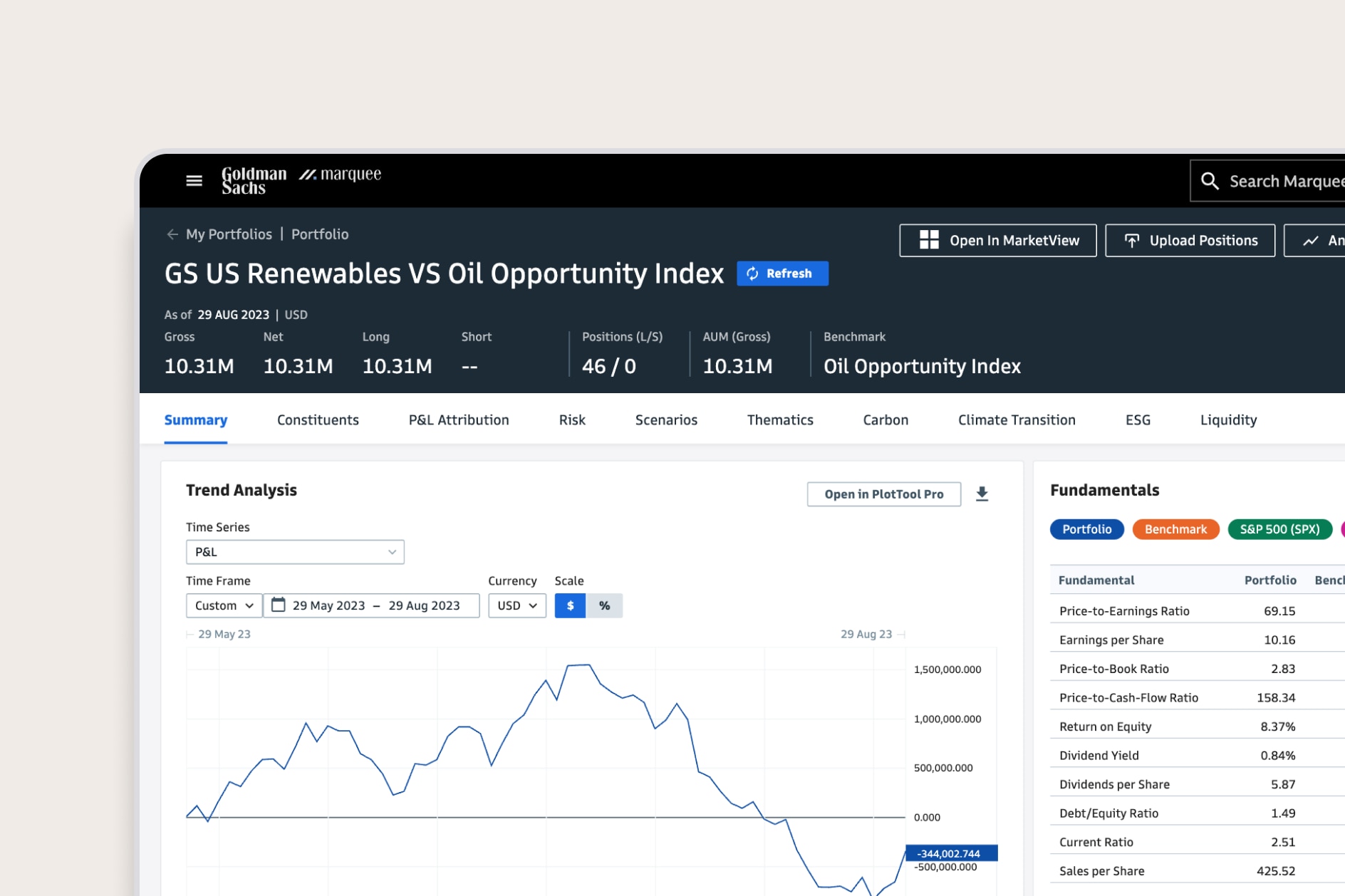

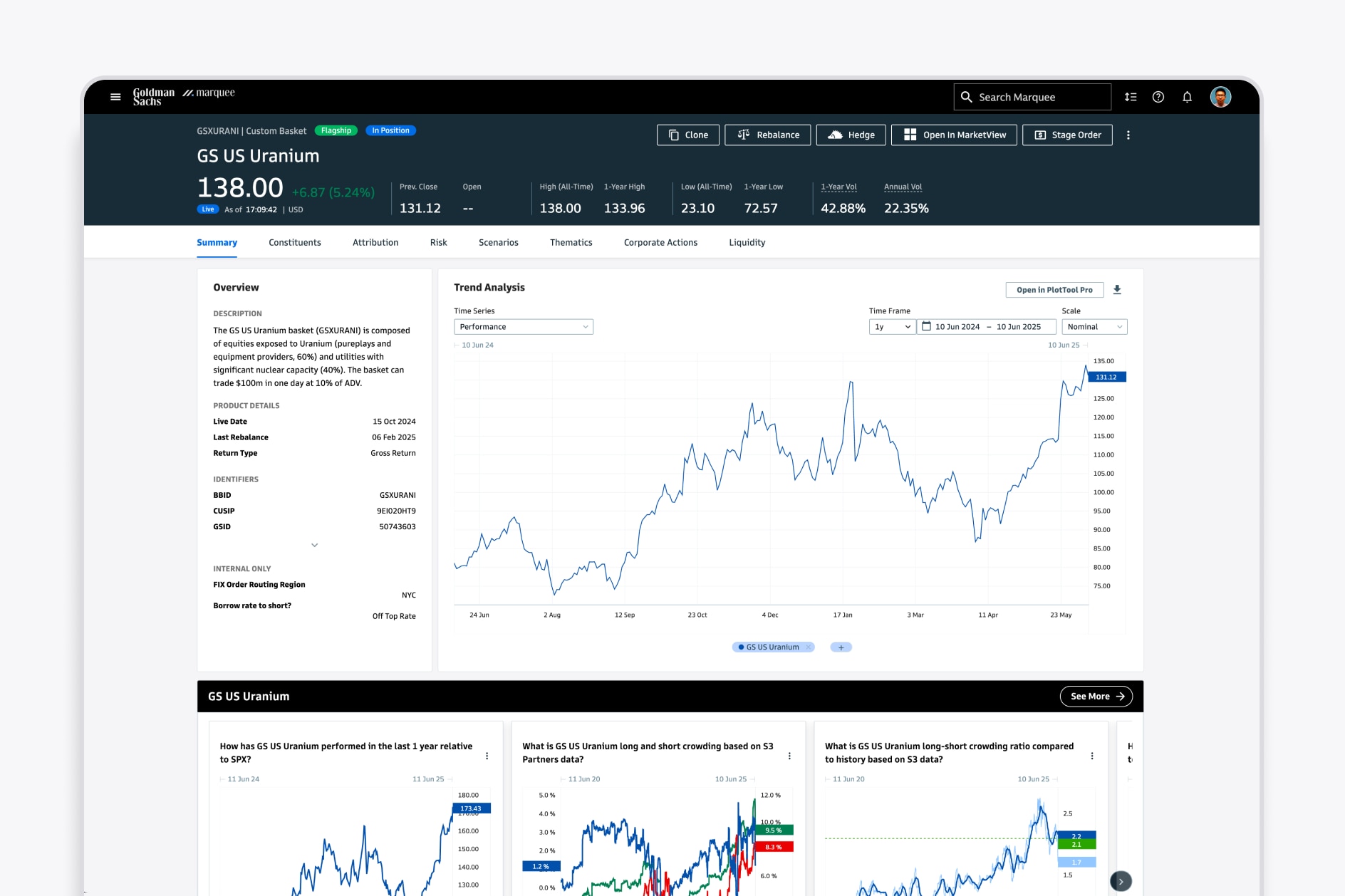

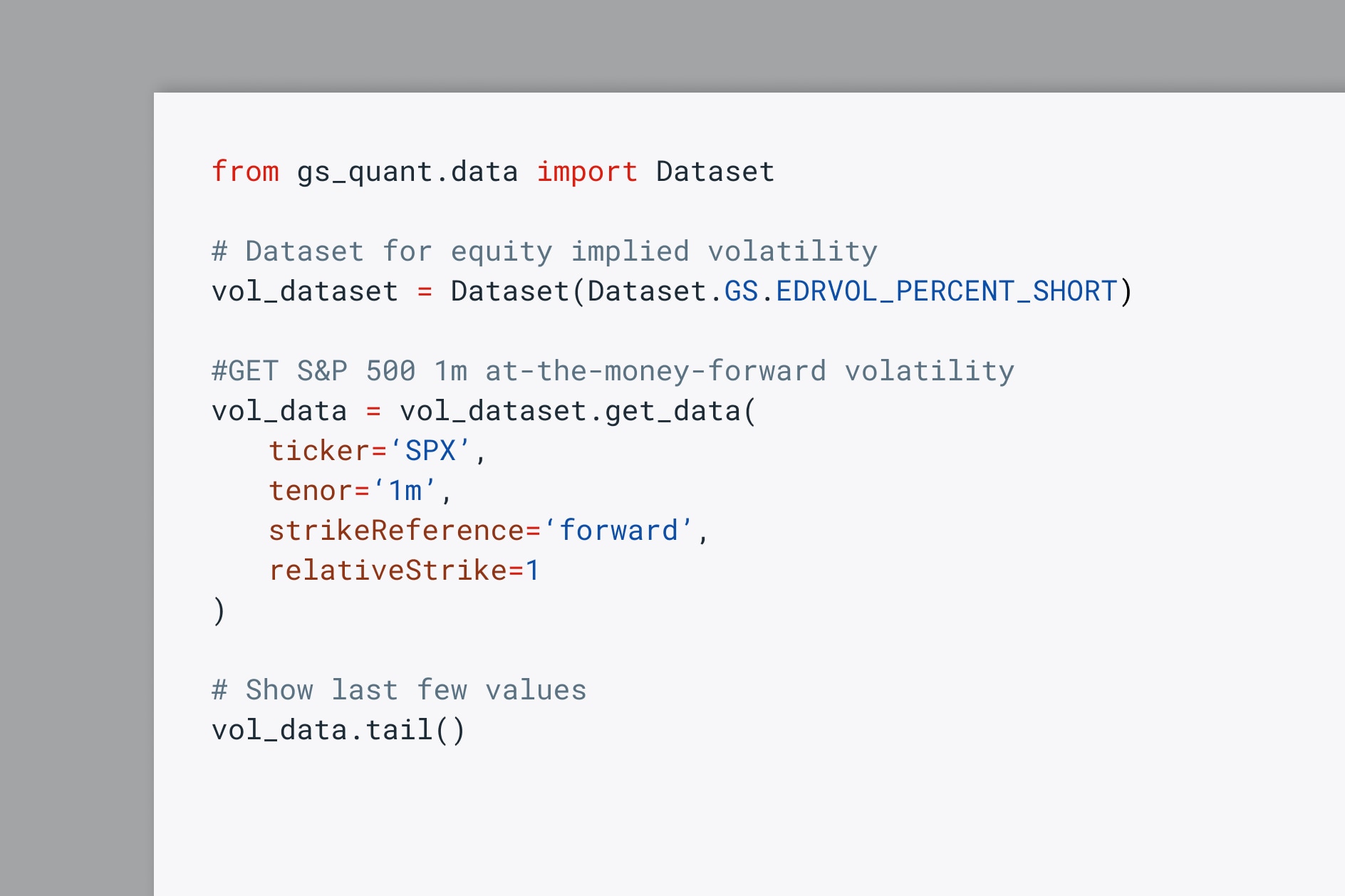

Products Built for You

The names "Goldman Sachs," and "Marquee" are the trademarks or registered trademarks of Goldman Sachs.

© 2026 Goldman Sachs & Co. LLC. All rights reserved. Descriptions of the products and services available through the Marquee platform provided herein are for educational purposes only and do not reflect all information that may be relevant in determining whether use of any such product or service is suitable for your circumstances. Goldman Sachs is not recommending that you take any action based on any information presented herein, which may be updated or modified form time-to-time by Goldman Sachs in its sole discretion without prior notice or subsequent notification. Prior to utilizing product or service available through the Marquee platform, you should read carefully any related disclosure provided by Goldman Sachs, including any information to which you may be required to agree and acknowledge or any user agreements that you may be required to execute, and make an independent determination regarding the suitability of your use of the relevant product or service.

The reference to or appearance of another company’s name, trademark, or logo in these materials / on this site does not constitute or imply, and is not intended to constitute or imply, any type of affiliation, endorsement, sponsorship, approval, or the like by or between such company and Goldman Sachs or any of their respective products, services, or affiliates. Any such reference or appearance is made for informational purposes. All such names, marks, and logos are the intellectual property of their respective owners.