Seamlessly integrate your portfolios within Marquee’s ecosystem and benefit from the same analytics tools that Goldman Sachs’ Equity desks rely upon.

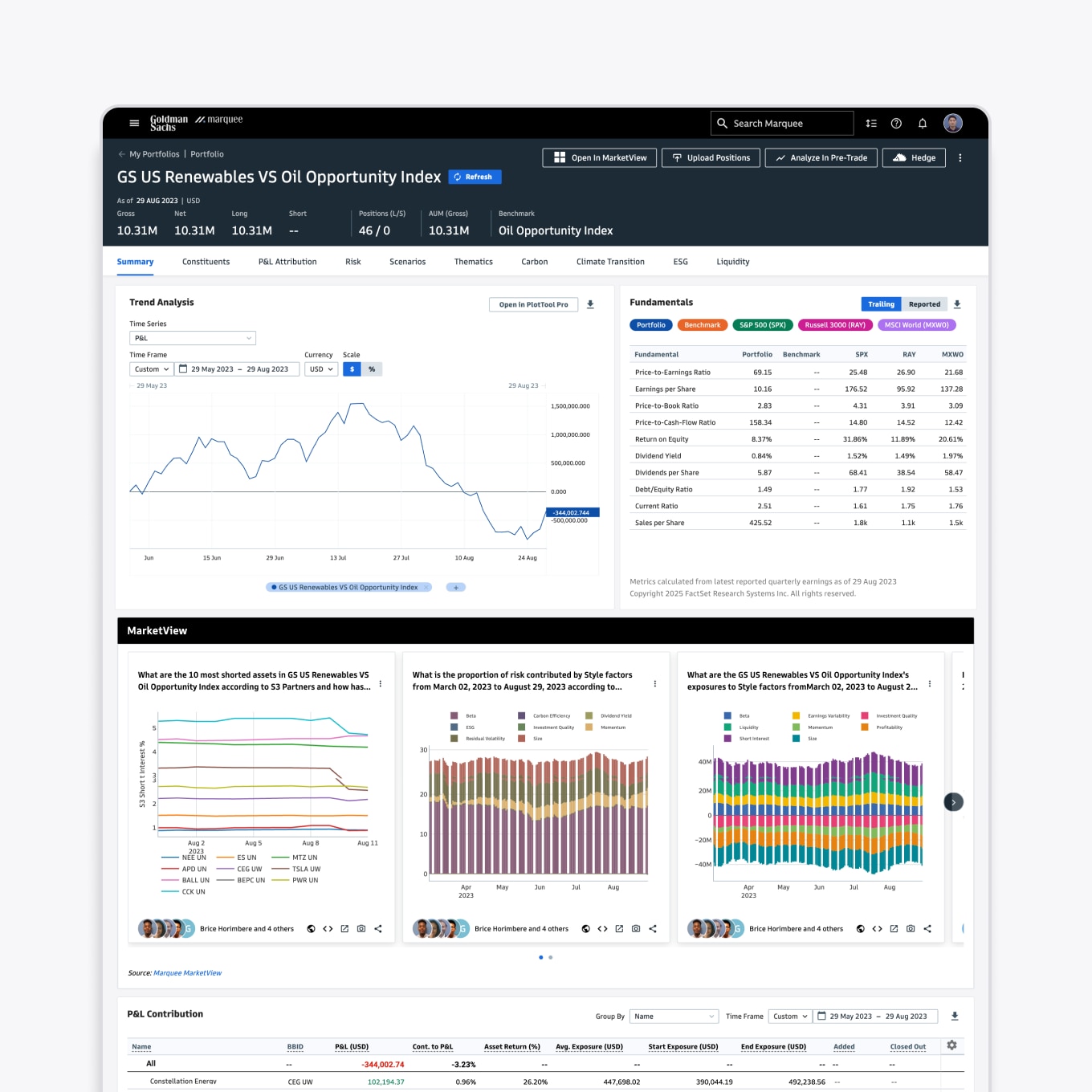

Recognize principal performance and risk drivers of your portfolio and understand behavior and market action over time. Decompose risk across numerous dimensions including region, currency, industry, style, or macro factors.

Use our scenario analysis tool on your portfolios and baskets to model a wide range of historical and hypothetical events, shock the underlying factors and monitor the impact on your portfolios.

Our wide range of industry-leading partners bring you an expansive and diverse set of risk factor models, configurable to support your unique portfolio analysis.

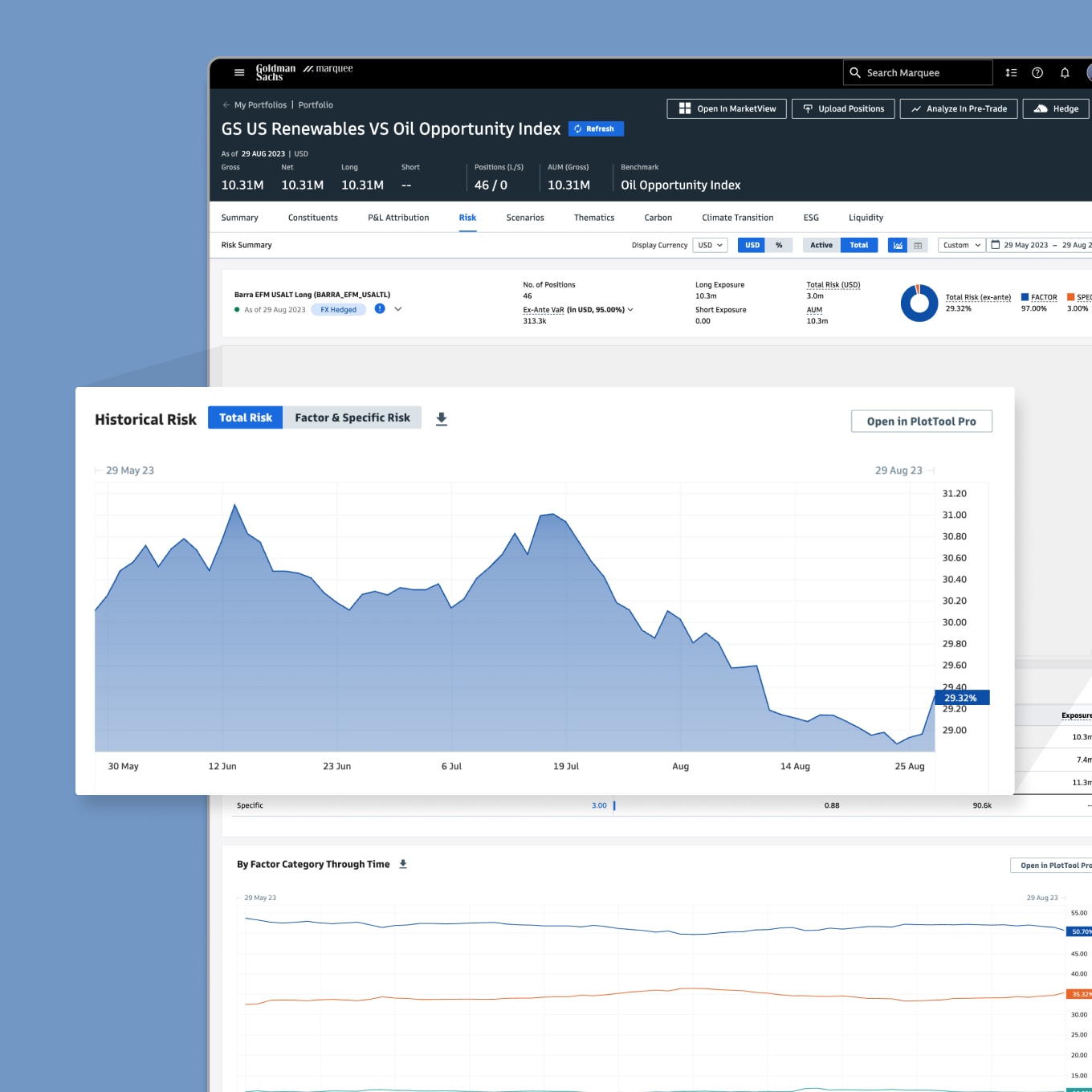

Select a factor model based on different investment horizons, regions and dimensions. Run factor reports on your portfolios or systematically access analytics and risk model data directly through APIs.

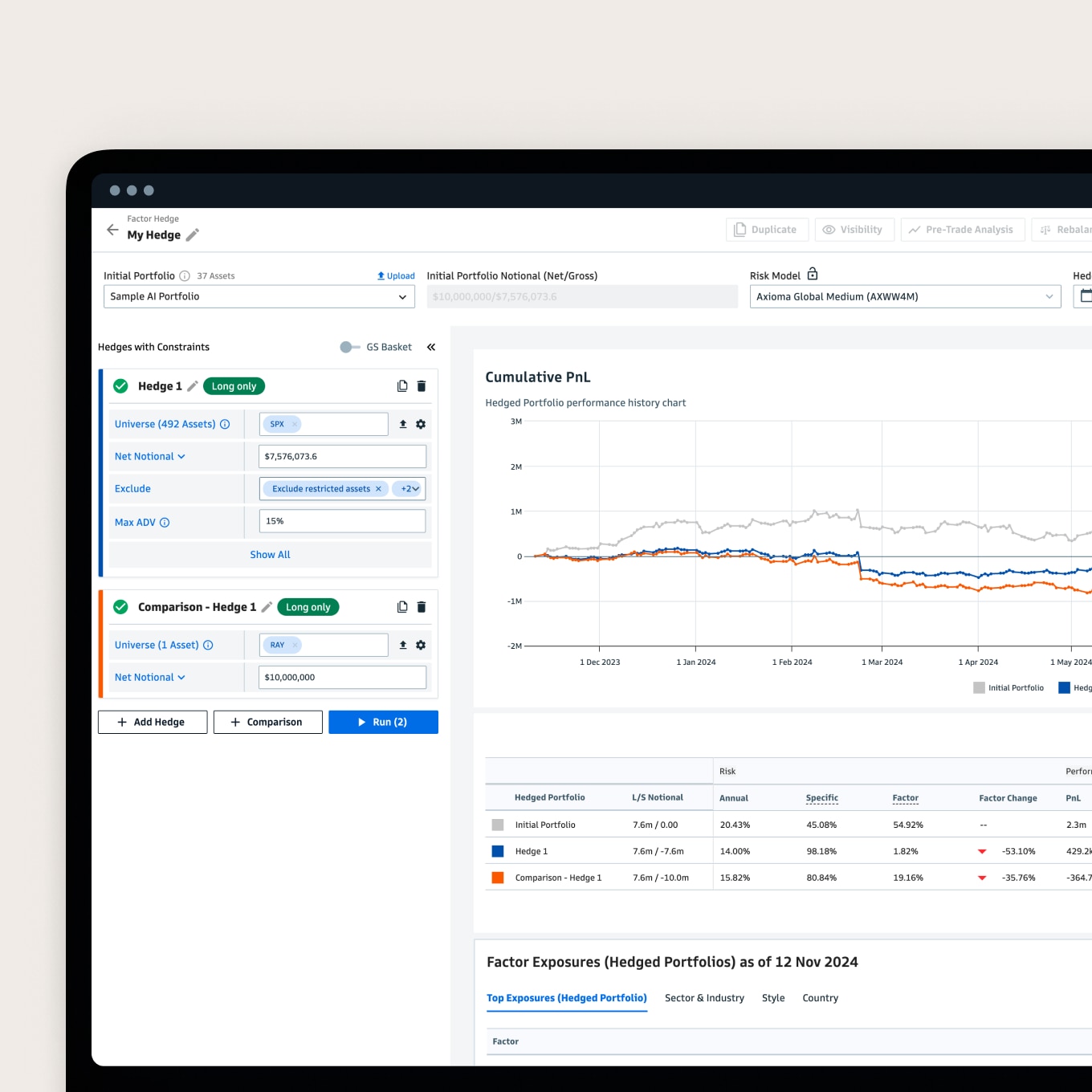

Our factor hedger allows you to construct and compare multiple hedges, on the fly, for your portfolios to minimize unintended factor exposures. Identify the GS Flagship Basket that best matches your constraints, or alternatively, create your own custom hedge.

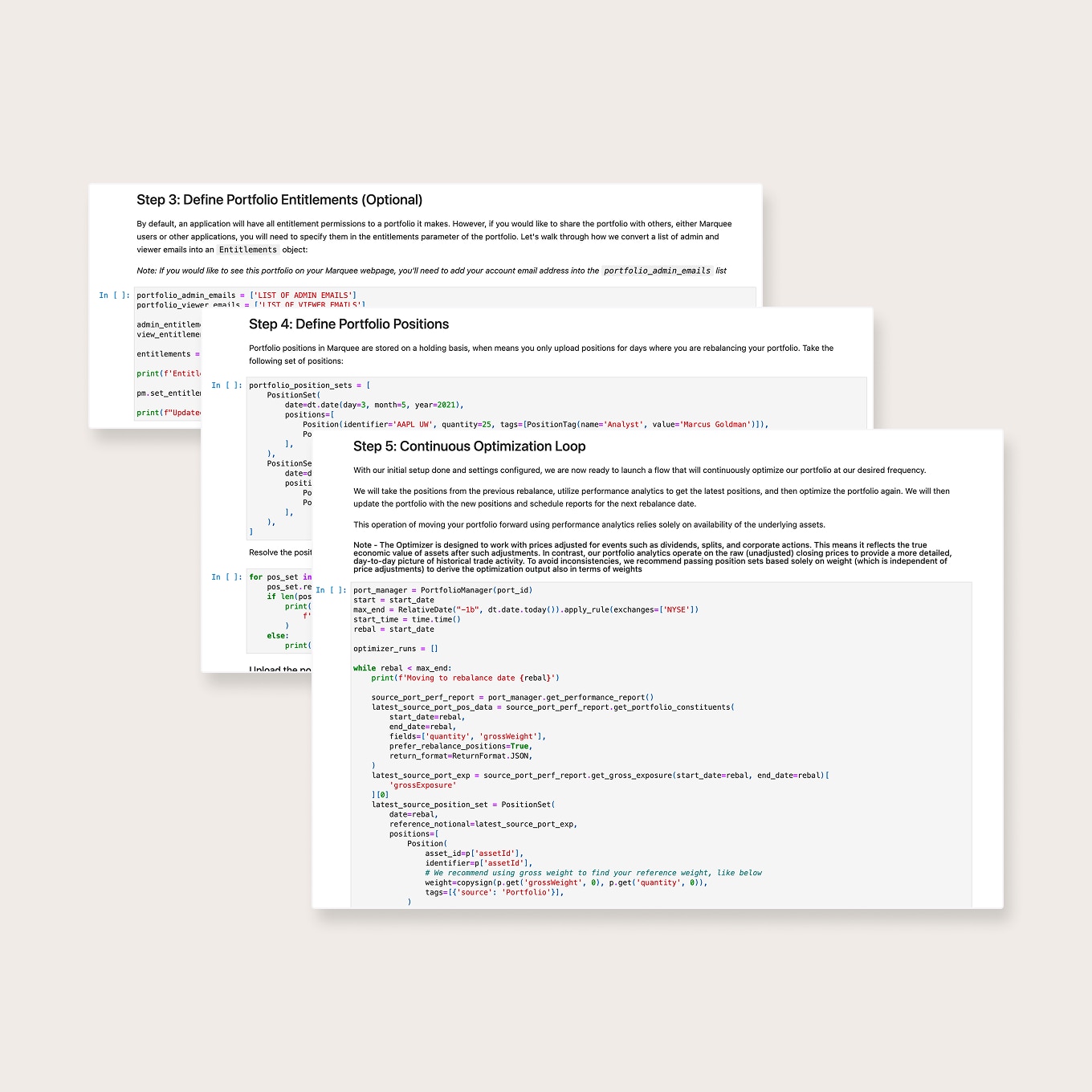

Marquee offers multiple channels to integrate and analyze your portfolio including our intuitive web interface, APIs, or through GS Quant - our open-source Python toolkit for quantitative finance.

Additionally, you can integrate your portfolio holdings data from fund administrators, custodians, and Order Management Systems (OMS), removing the need for manual updates and ensuring your workflow is as streamlined as possible.

With Quant Backtesting (QBT) for Equities, you can now run historical portfolio optimizations systematically, leveraging our Python SDK toolkit GS Quant, the Axioma Optimizer and market-leading factor risk models.

Alongside Goldman Sachs Security Master, the service allows quants to nimbly work with historical identifiers to maintain correct security lineage and backtest strategy stability.

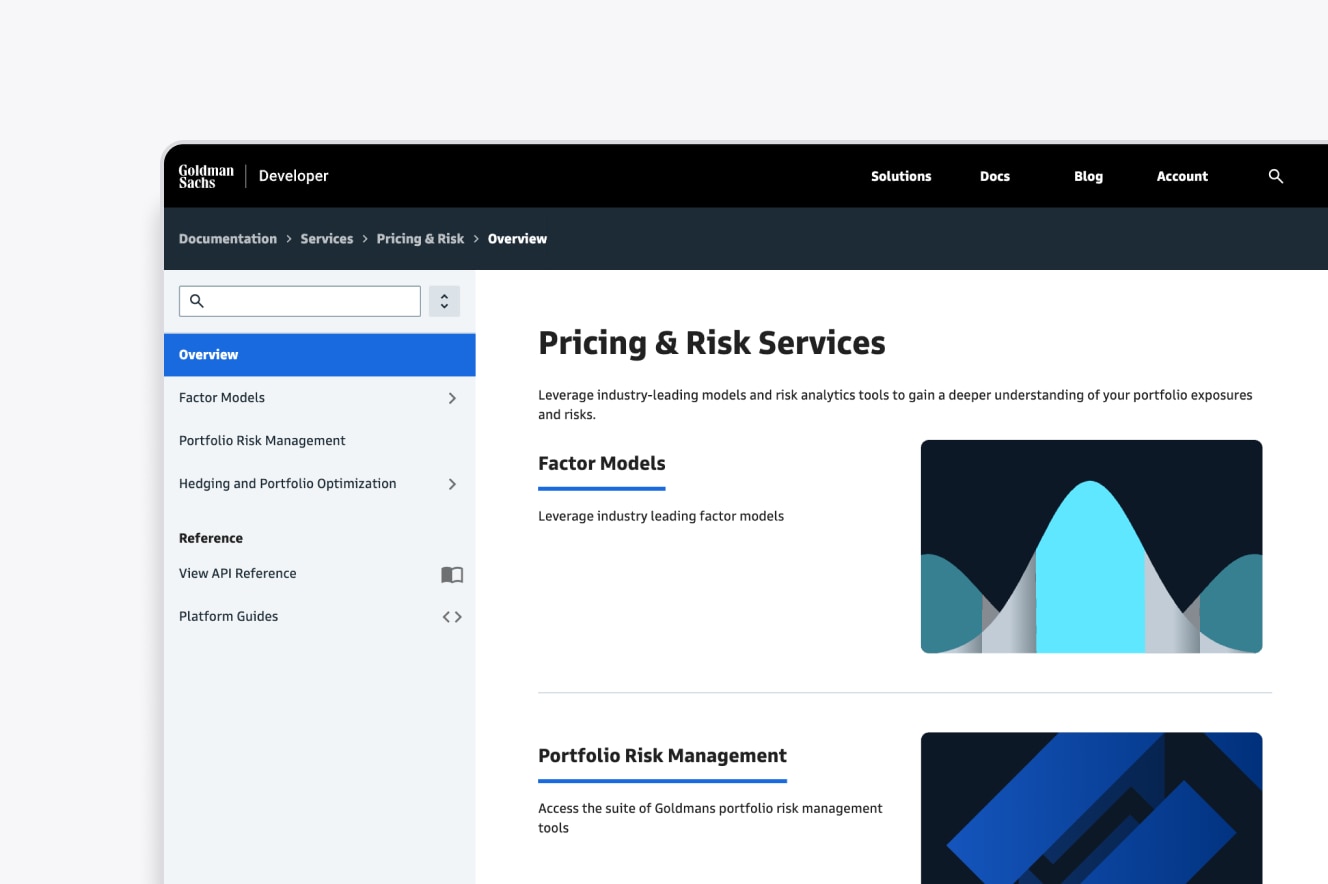

Explore our documentation on how you can gain a deeper understanding of your portfolio exposures and risks.

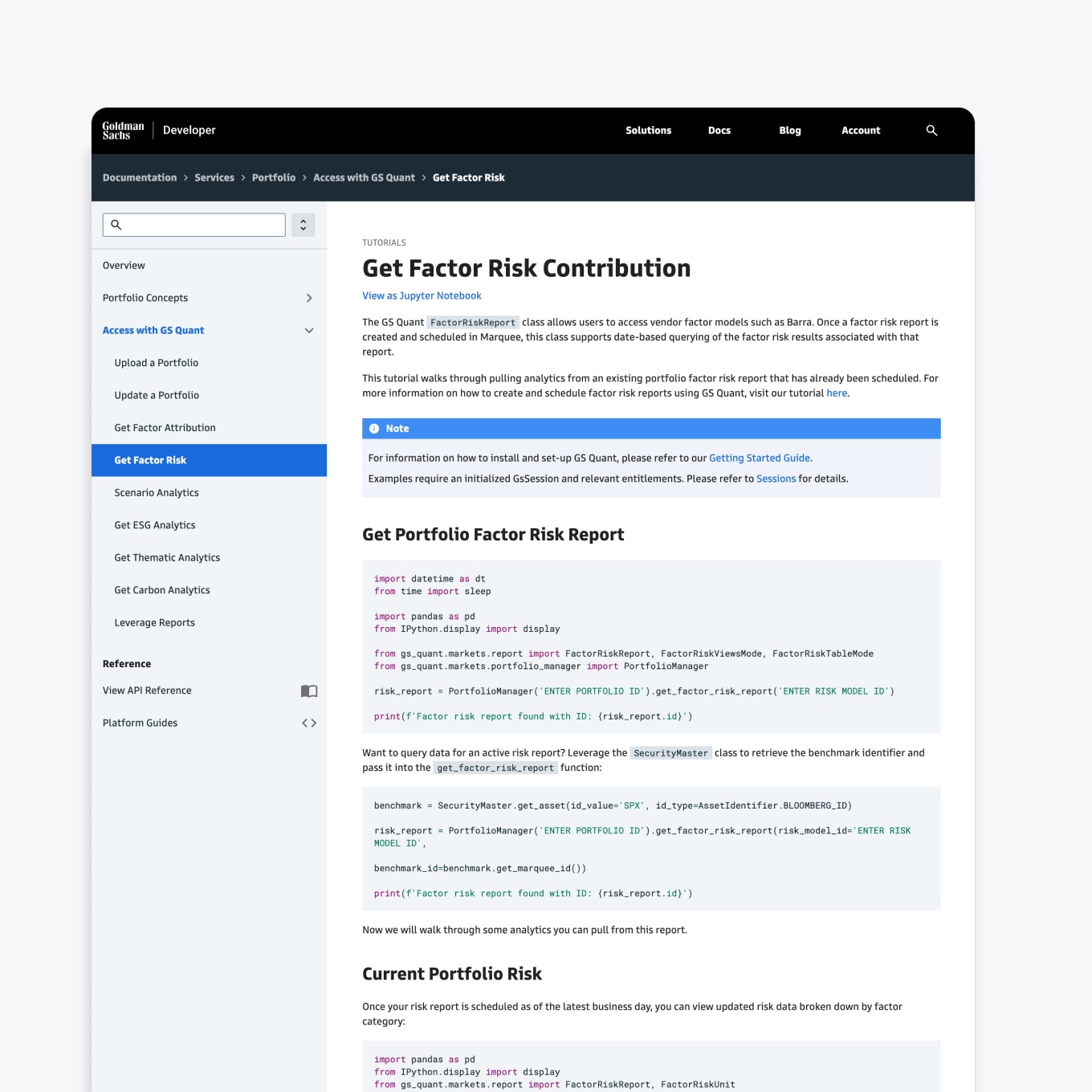

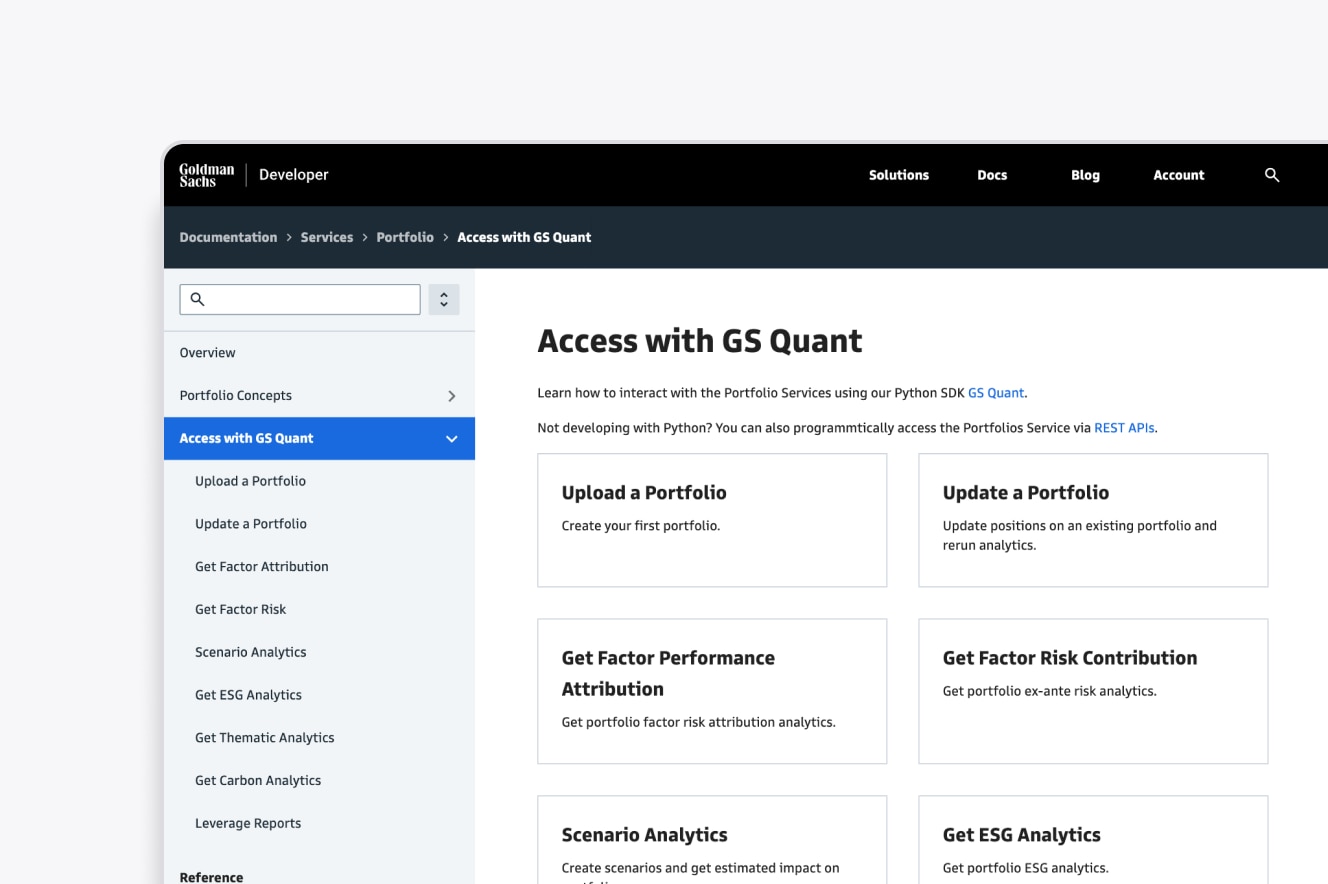

Learn how to interact with the Portfolio Services using our Python SDK GS Quant.

The names "Goldman Sachs," and "Marquee" are the trademarks or registered trademarks of Goldman Sachs.

© 2026 Goldman Sachs & Co. LLC. All rights reserved. Descriptions of the products and services available through the Marquee platform provided herein are for educational purposes only and do not reflect all information that may be relevant in determining whether use of any such product or service is suitable for your circumstances. Goldman Sachs is not recommending that you take any action based on any information presented herein, which may be updated or modified form time-to-time by Goldman Sachs in its sole discretion without prior notice or subsequent notification. Prior to utilizing product or service available through the Marquee platform, you should read carefully any related disclosure provided by Goldman Sachs, including any information to which you may be required to agree and acknowledge or any user agreements that you may be required to execute, and make an independent determination regarding the suitability of your use of the relevant product or service.

The reference to or appearance of another company’s name, trademark, or logo in these materials / on this site does not constitute or imply, and is not intended to constitute or imply, any type of affiliation, endorsement, sponsorship, approval, or the like by or between such company and Goldman Sachs or any of their respective products, services, or affiliates. Any such reference or appearance is made for informational purposes. All such names, marks, and logos are the intellectual property of their respective owners.