Implement your currency hedging strategy without significant technology investment.

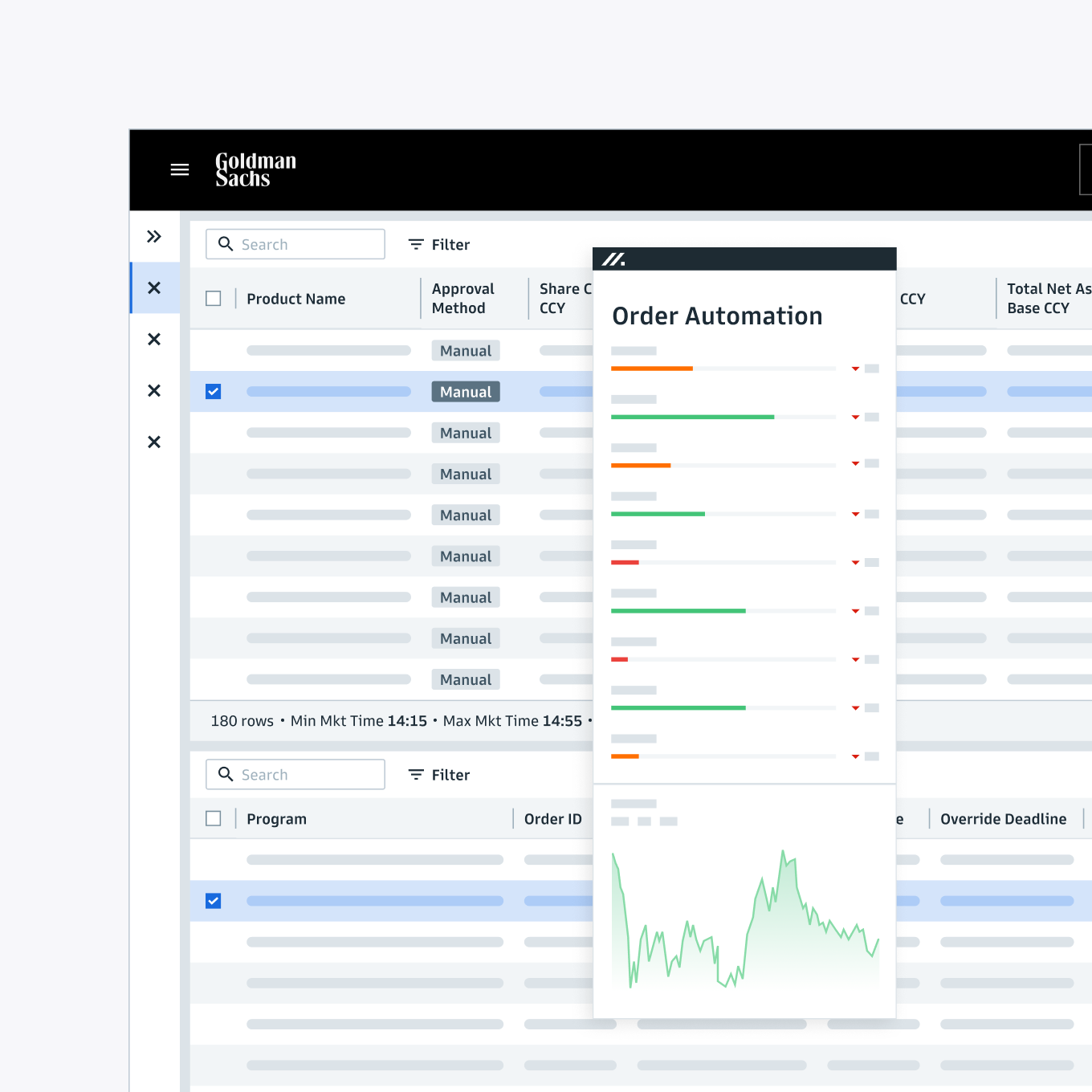

Leverages Passive Currency Overlay to support the calculation, execution, and settlement of non-alpha-generating workflows.

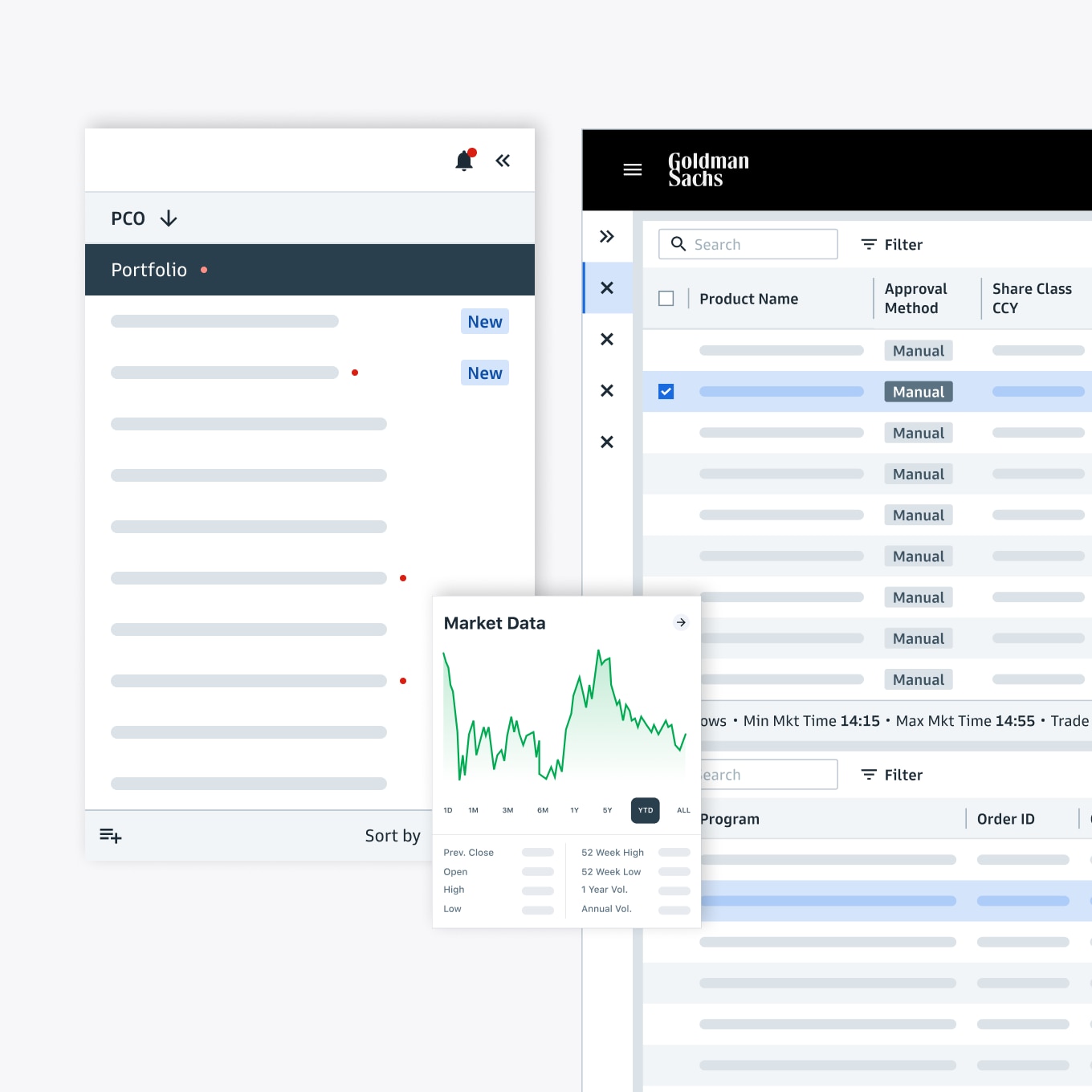

The streamlined process, featuring integrated data feeds and configurable hedging options, reduces operational risks and costs. The tool supports portfolio and share class hedging, as well as FX cash management workflows.

This flexible, web-based application integrates with most major systems to pull in your portfolio and automate FX hedging. By automating order generation based on current and targeted exposures, the tool may help mitigate risks such as calculation errors, missed trades, and execution failures.

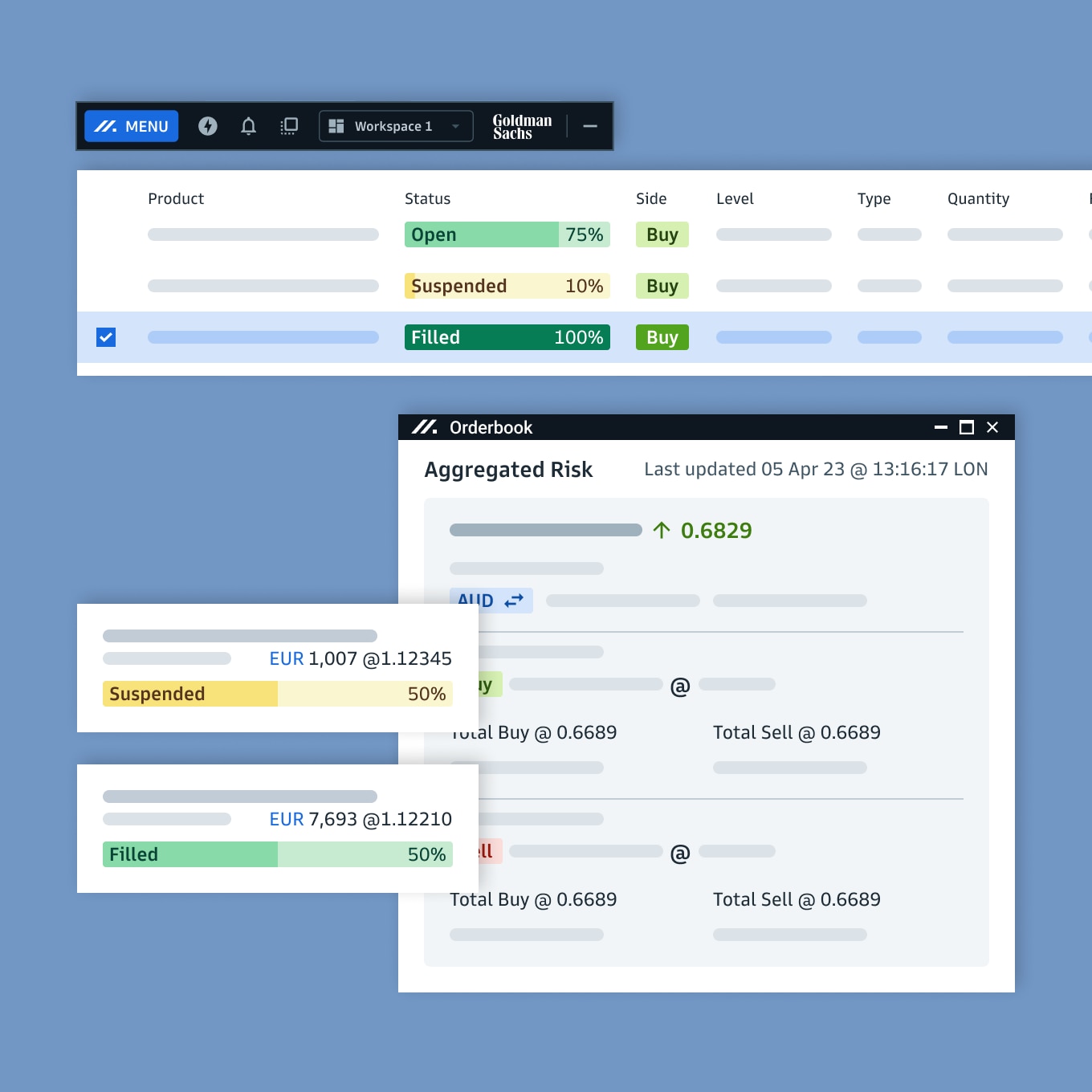

Customize your hedging pricing preferences and other parameters to receive an optimized currency hedging workflow that is tailored to your unique execution needs. Leverage a standard fixing rate for transparent trade execution, or trade on Goldman Sachs liquidity with real-time RFQ or Algos. Trade netting is also available, for improved operational efficiency.

The names "Goldman Sachs," and "Marquee" are the trademarks or registered trademarks of Goldman Sachs.

© 2025 Goldman Sachs & Co. LLC. All rights reserved. Descriptions of the products and services available through the Marquee platform provided herein are for educational purposes only and do not reflect all information that may be relevant in determining whether use of any such product or service is suitable for your circumstances. Goldman Sachs is not recommending that you take any action based on any information presented herein, which may be updated or modified form time-to-time by Goldman Sachs in its sole discretion without prior notice or subsequent notification. Prior to utilizing product or service available through the Marquee platform, you should read carefully any related disclosure provided by Goldman Sachs, including any information to which you may be required to agree and acknowledge or any user agreements that you may be required to execute, and make an independent determination regarding the suitability of your use of the relevant product or service.

The reference to or appearance of another company’s name, trademark, or logo in these materials / on this site does not constitute or imply, and is not intended to constitute or imply, any type of affiliation, endorsement, sponsorship, approval, or the like by or between such company and Goldman Sachs or any of their respective products, services, or affiliates. Any such reference or appearance is made for informational purposes. All such names, marks, and logos are the intellectual property of their respective owners.