iShares® ETFs on Marquee

An in-depth look into world-class ETFs powered by leading portfolio analytics

Contact UsA transparent view to inform investment decisions

Goldman Sachs Marquee and iShares by BlackRock are collaborating to unlock the full-spectrum of portfolio analytics for a wide range of iShares ETFs - delivering enhanced efficiency, transparency and control.

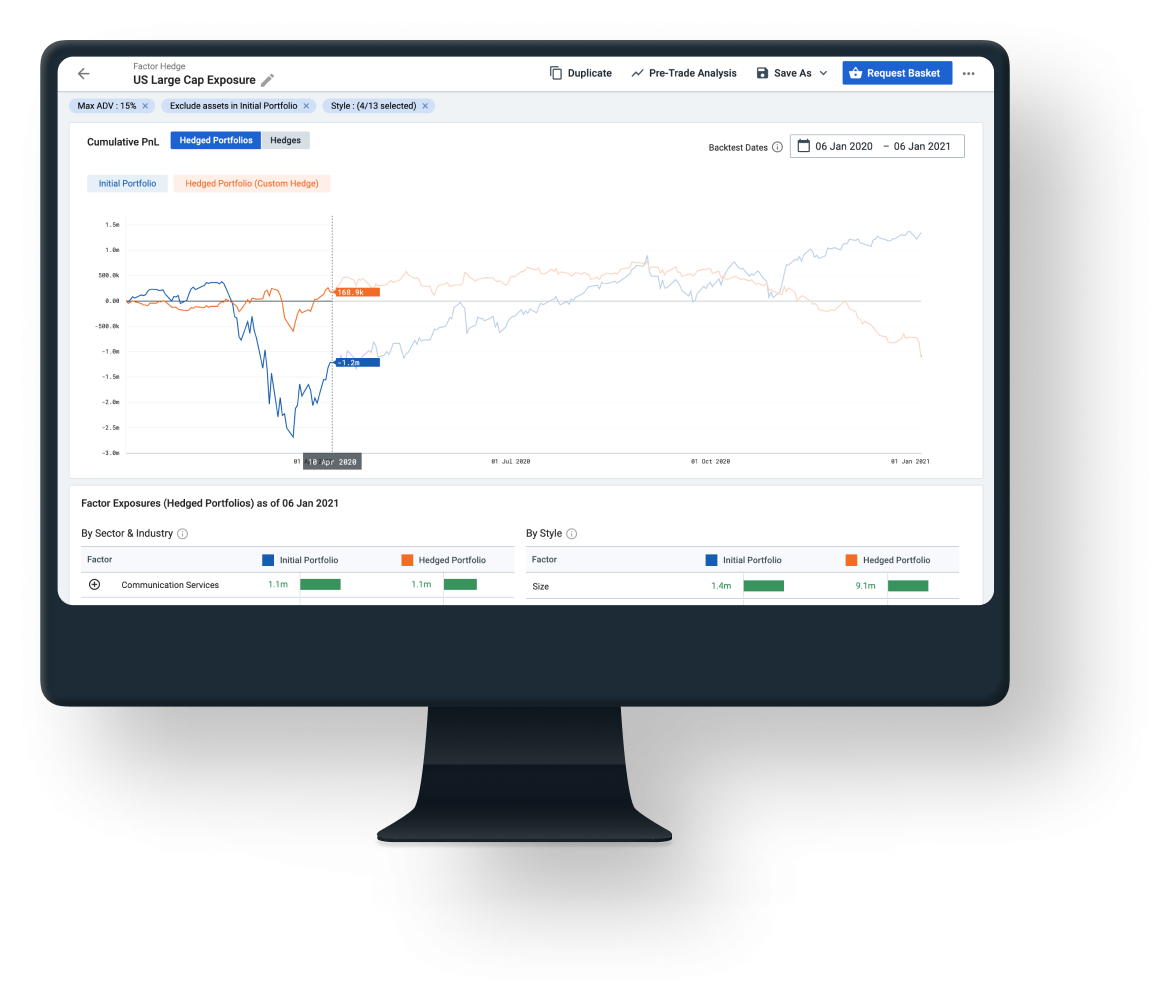

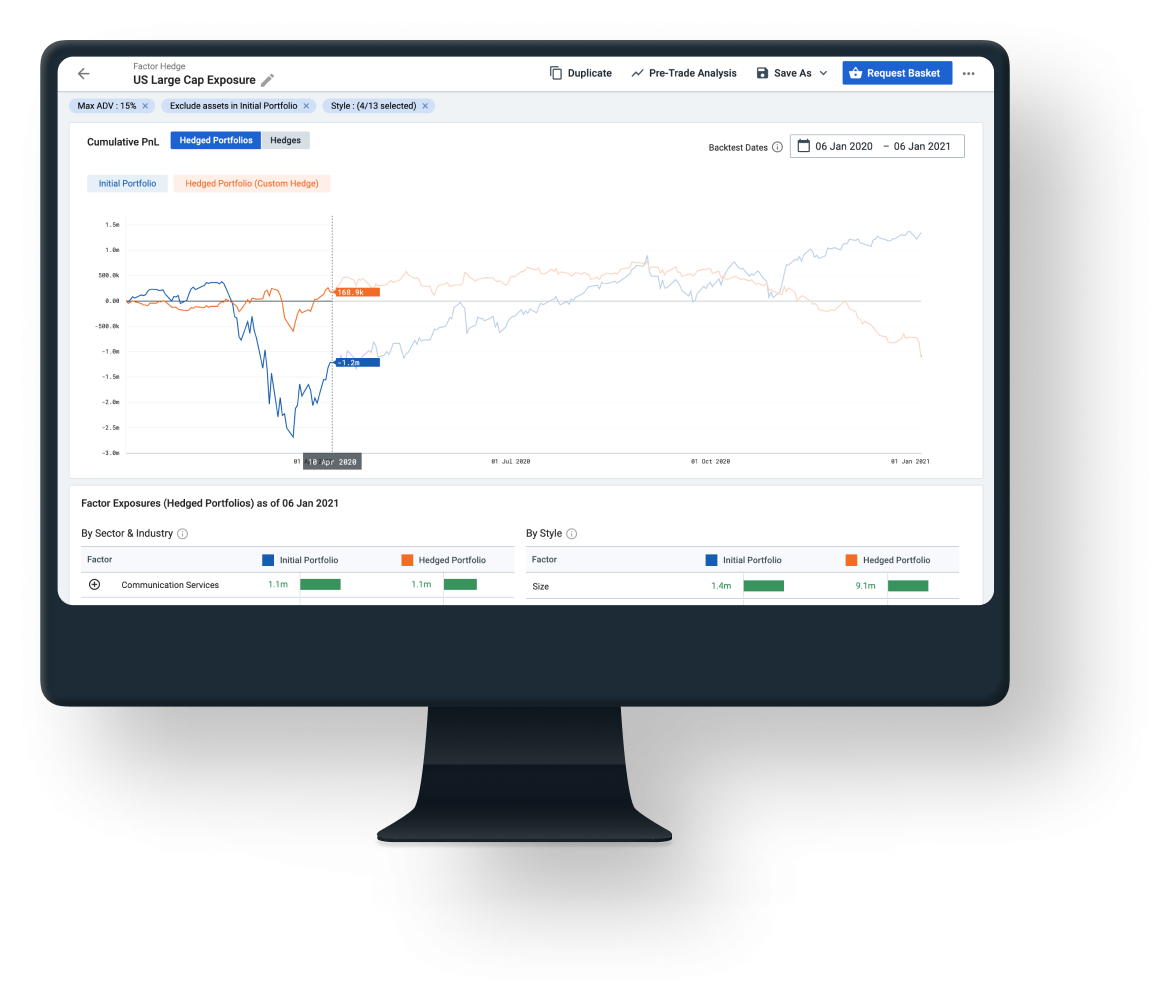

In-depth portfolio analytics

Better understand the risk and return profile of select iShares ETFs

- Identify performance and risk drivers through lenses such as sector, factor, style, and more, within Marquee

- Compare your portfolio versus an iShares ETF as a benchmark

Enhanced pre-trade analysis and hedging

Use iShares ETFs as the starting point to:

- Analyze and dissect potential trade ideas

- Create bespoke hedges to optimize your portfolio’s performance and minimize exposures to various risk dimensions

Scalable access

Access fund constituent-level data via Goldman Sachs’ flexible portfolio analytics ecosystem

- Analyze iShares ETFs holdings through Marquee’s intuitive web interface

- Access the constituent information and derived analytics programmatically via APIs and GS Quant, our Python Toolkit

About iShares

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, a global line-up of exchange traded funds (ETFs) and $2.78 trillion in assets under management as of June 30, 2022, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

Interested in learning more?

Our team is available for questions, demos, and to provide Marquee access