Managed Tick Data

Access normalized, historical equity top of the book tick data from multiple global execution venues.

Contact UsView Documentation"Our data management process being significantly simplified and streamlined"

“At Capital Group we are focused on delivering superior results using high-conviction portfolios and rigorous research. As a development partner and early adopter of this new service, we are delighted to see our data management process being significantly simplified and streamlined, freeing up time and resources pertaining to running post-trade execution analytics." - XXX, Capital Group.

Simplify the acquisition and consumption of high frequency tick data

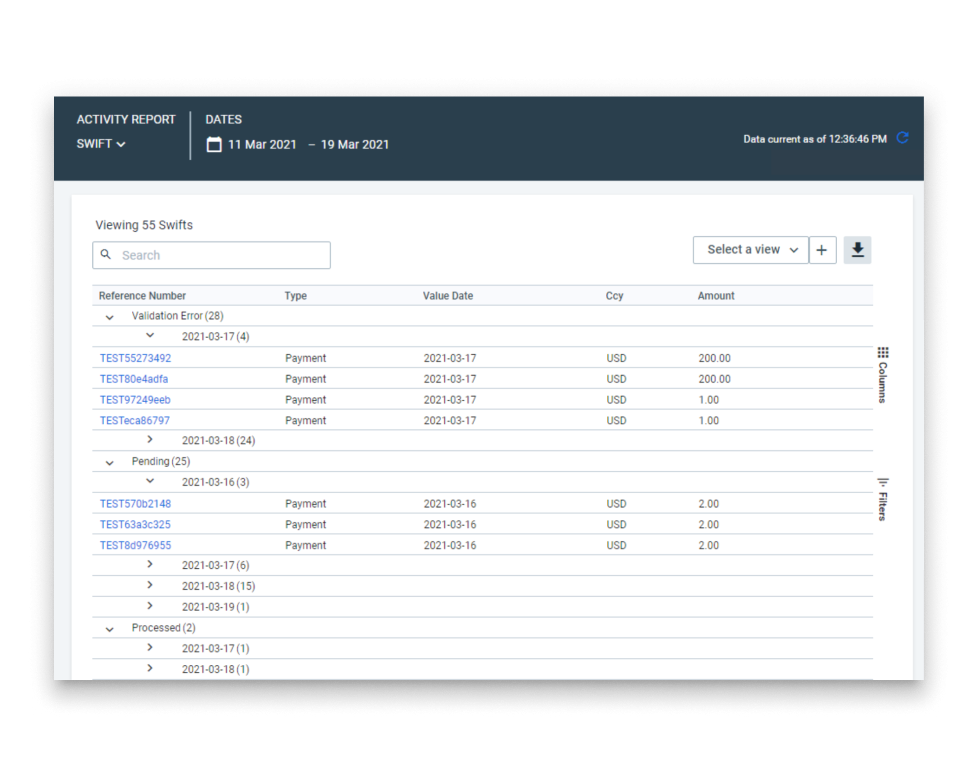

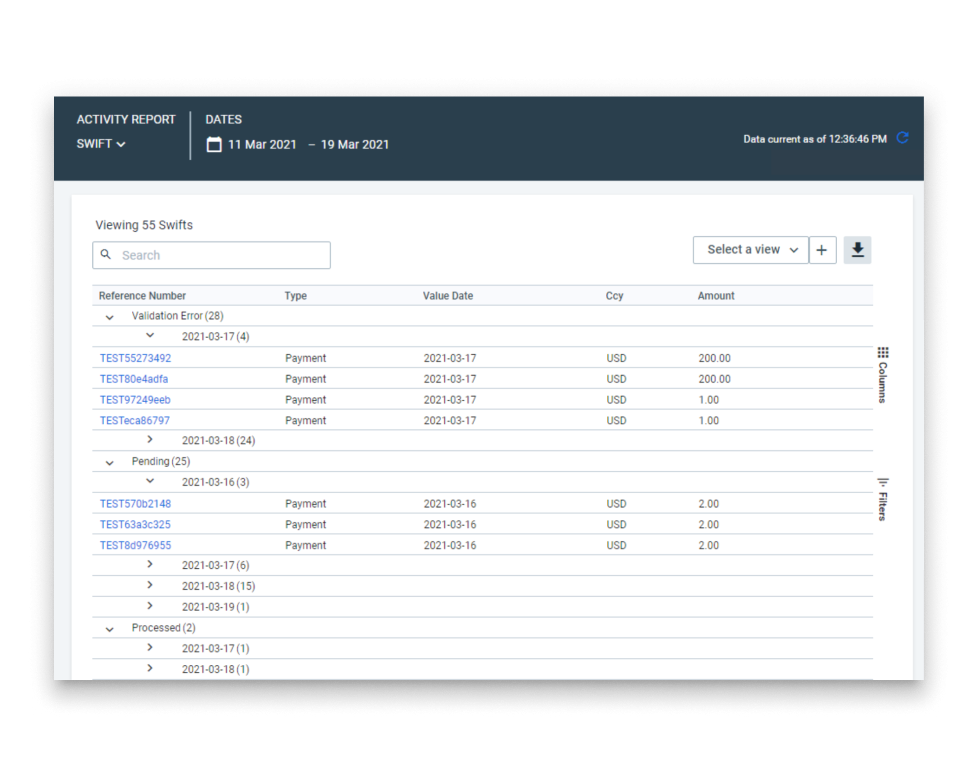

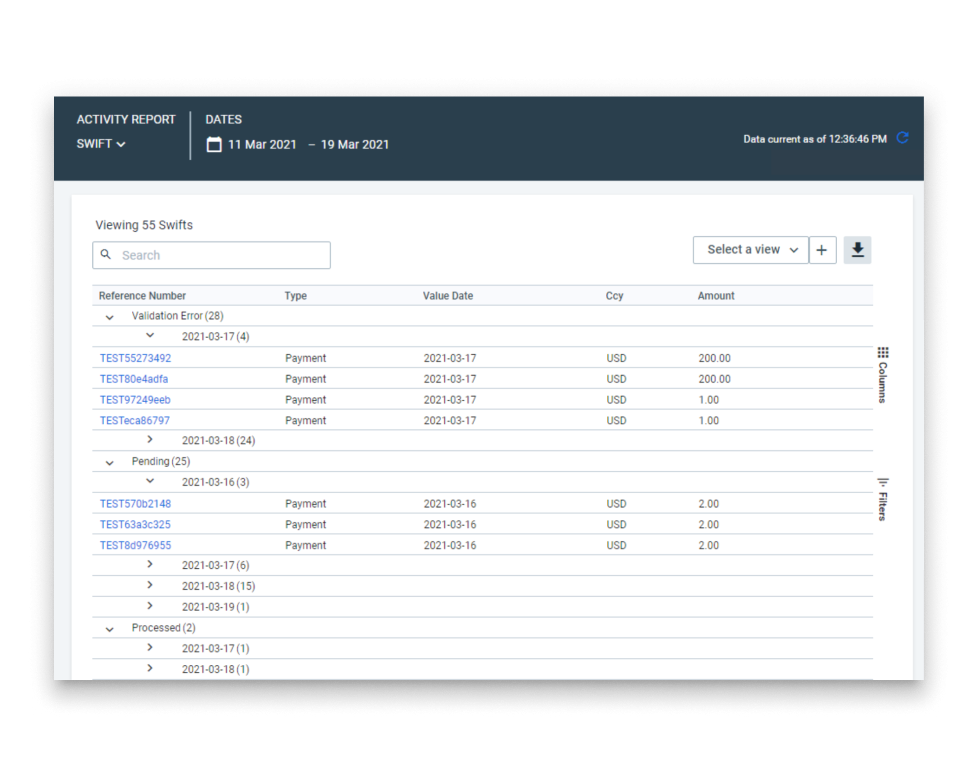

The Managed Tick Data service from Goldman Sachs allows for access to normalized, historical equity top of the book tick data from multiple global execution venues. The service provides the ability to produce a consolidated view across fungible execution venues, including those that lack an official consolidated tape, i.e., European exchanges.

Remove the operational overhead required to manage petabyte-scale infrastructure

Access Goldman Sachs' managed time series database using multiple symbology standards for tick data storage and compute, including integrated point-in-time corporate actions adjustment factors for multi-day order analysis. Identify auction, lit, dark, and block trades regardless of where the trades are reported.

Leverage a purpose-built analytics library designed and used daily by Goldman Sachs strategists

Featuring a server-side analytics library for Downsampling, Bar Summaraization, Markouts, and bechmarks calculation including VWAP, TW, and PWP. Access 100+ end of day top of the book summary statistics.

Interested in learning more?

Our team is available for questions, demos, and to provide Marquee access