Quant Insight Now on Marquee

Data science-driven macro models for risk monitoring and attribution

Contact UsMarket-leading quantitative macro data analysis

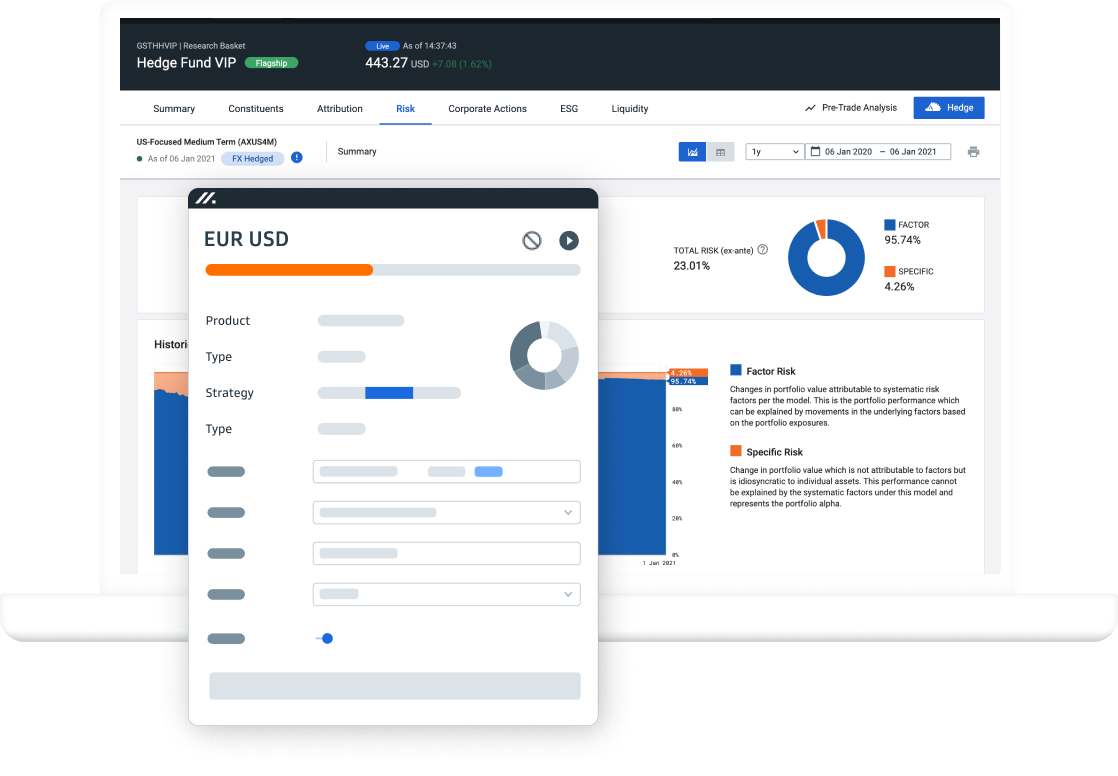

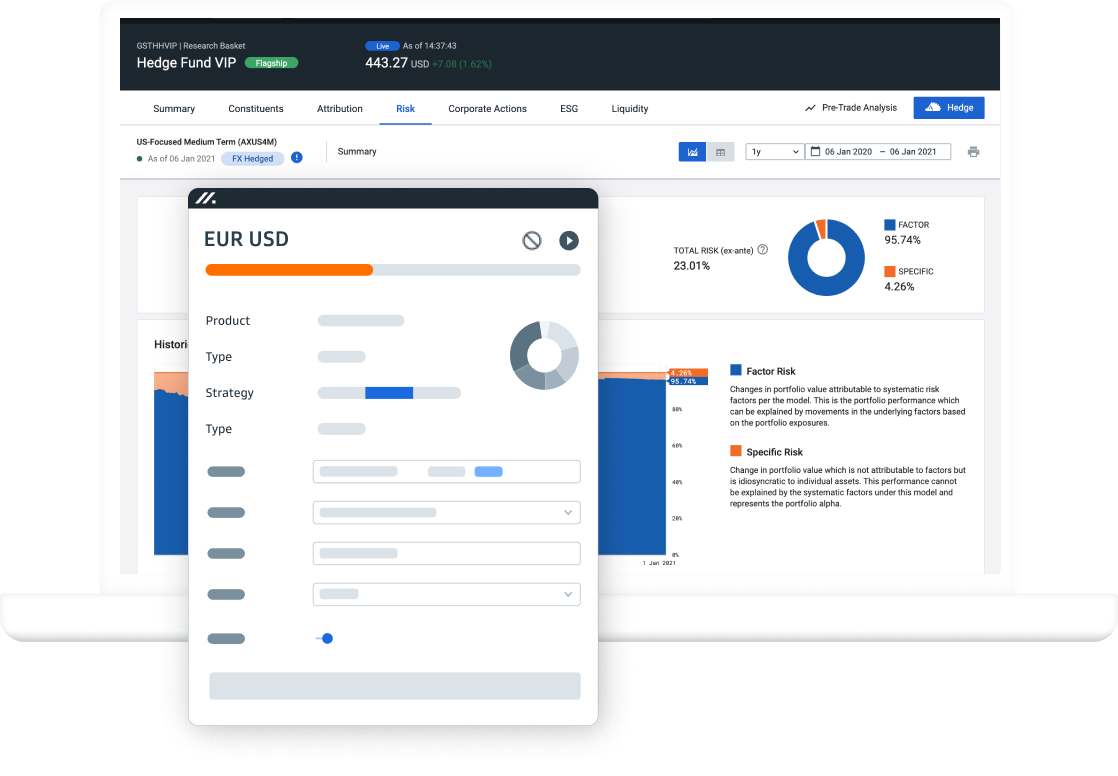

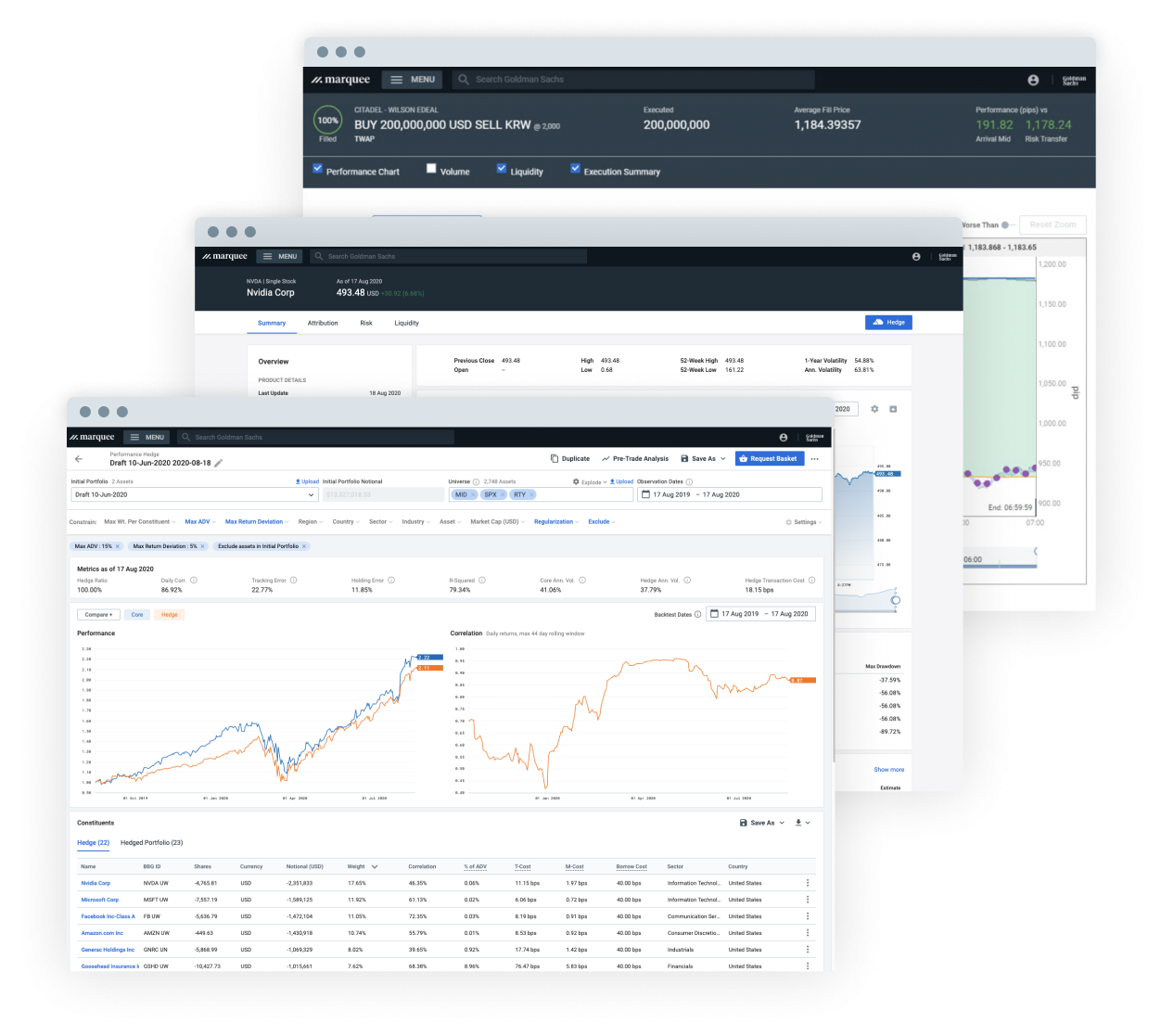

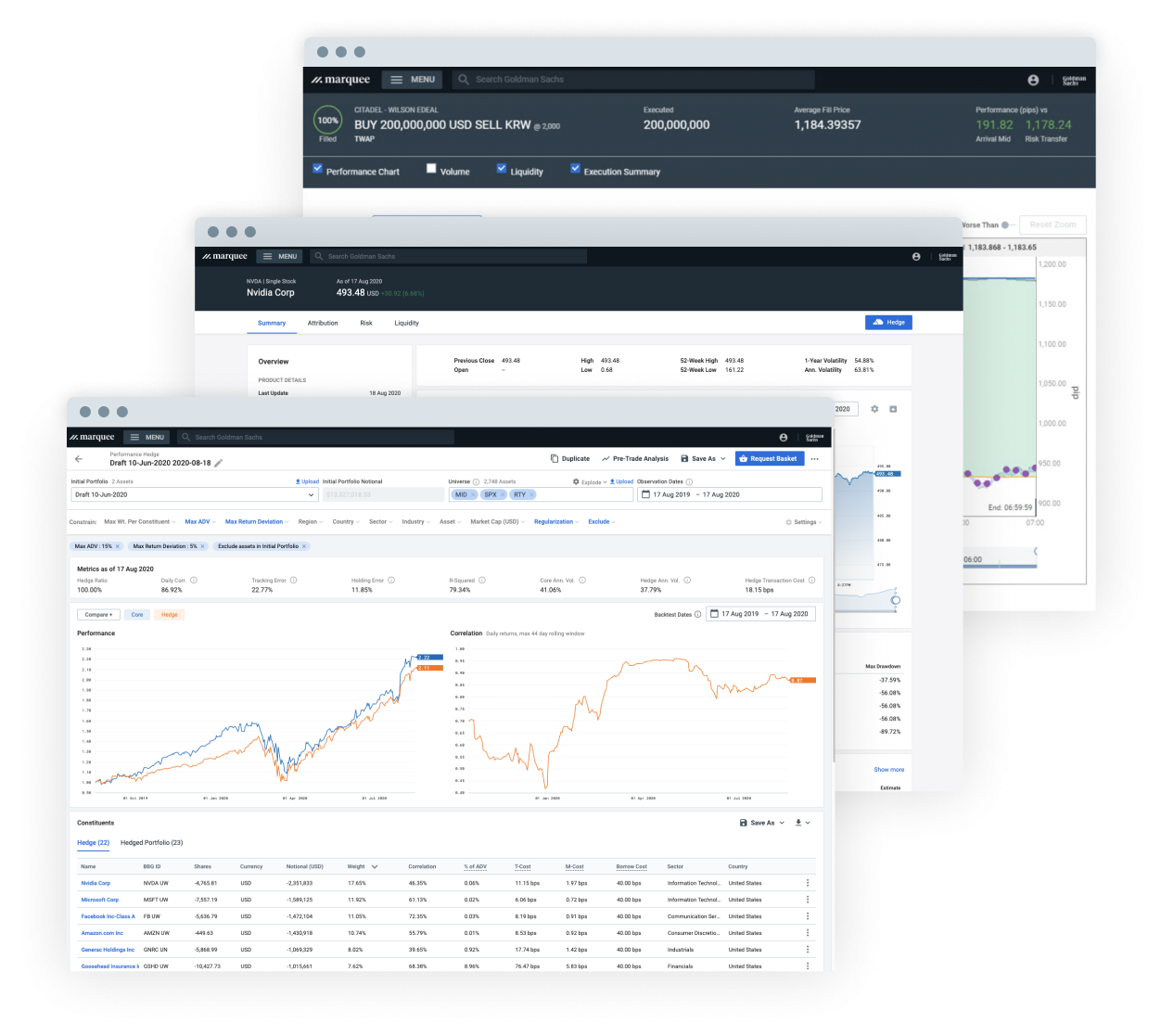

Goldman Sachs and Quant Insight (Qi) are collaborating to deliver Qi's unique macro analytics via Marquee for enhanced asset selection and portfolio risk management workflows. Leverage Qi's robust framework to construct, test, and monitor portfolios through a rigorous macro lens.

Macro insights

Uncover hidden, exogenous macro risks within your portfolio

- Unlock insights based on 39 macro drivers on individual assets within your portfolio

Asset allocation

Make asset allocation decisions based on underlying assets’ sensitivities to factors, including:

- Economic fundamentals, including real GDP growth and inflation for major economies

- Financial conditions, including real rates, shape of the yield curve, shifts in Central Bank policy expectations, and trade-weighted foreign exchange

- Risk aversion factors, including equity index, bond, and currency volatility; regional and emerging market stress; and other indicators

Extensive coverage

Access macro factor sensitivity data for thousands of instruments across:

- Global equity stocks

Qi's factor models via Marquee

Access Qi’s macro factors, macro regime change indicators, and more via Goldman Sachs’ flexible portfolio analytics ecosystem—programmatically via API or through our open-source Python toolkit, GS Quant

Programmatic access to Qi factor models

GS Quant, our open-source Python toolkit designed to rapidly and seamlessly integrate data, provides a programmatic environment to access Qi's macro drivers in a scalable manner.

Learn More

Discover Quant Insight

Quant Insight (Qi) is a financial market analytics firm that empowers investors with actionable, high-integrity macro data and signals. Qi offers a powerful toolkit for alerting investors to hidden, exogenous macro risk. Qi macro analytics are designed to accurately measure a portfolio’s exposure to key macro factors. This is achieved by applying data science and machine learning techniques to extract macro sensitivities for thousands of securities across asset classes.

Interested in learning more?

Our team is available for questions, demos, and to provide Marquee access